US stocks fell Monday with the S&P 500 index coming off a five-year high as Wall Street shifted its focus from the nation’s fiscal woes to the start of corporate earnings season tomorrow.

Aluminum maker Aloca Inc will unofficially kick-off the fourth-quarter earnings season after the market closes on Tuesday. Fourth quarter earnings for S&P 500 companies are expected to rise 2.8 percent compared with the same period in 2011, according to Thomson Reuters data.

Meanwhile Republicans in Washington linked raising the US debt-ceiling to reduced spending on entitlement programs including Medicare, while Democrats looked for additional revenue. That will shape up to be a hard fought battle.

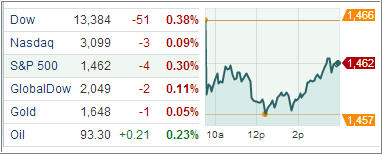

The Dow Jones Industrial Average (DJIA) dropped 51 points Walt Disney and Boeing fronting the losses. Banking stocks were in focus today after the Basel Committee on Banking Supervision, an international policy maker, watered down Sunday some of the more stringent liquidity rules for banks that would have required lenders to hold back cash they could use for lending.

The rules were originally proposed to help bank strengthen in the event of another meltdown. Regulators also gave banks four years to comply with the new standard.

The S&P 500 Index (SPX) shed 5 points with utilities and energy leading the slide and eight out of ten industry groups finishing in the red. Only telecommunication and healthcare firms finished the day higher.

Treasury yields rebounded with the 10-year benchmark yield hitting a near eight-month high on concern that the US Federal Reserve may wind down its stimulus measures earlier than most investors had anticipated.

The US dollar meanwhile lost ground against the euro Monday as investors remained uncertain about the next steps by the US Federal Reserve and the European Central Bank. The greenback failed to extend last week’s gains despite fears the Fed may wind down its bond-purchase program before the end of the year.

European stocks declined Monday with the pan-European Stoxx Europe 600 index retreating from its highest level in almost three years as traders booked profits, offsetting gains by banks after global regulators delayed and watered down new capital rules.

Our Trend Tracking Indexes (TTIs) changed only slightly with the Domestic TTI now sitting at +2.26%, while the International TTI hovers at +9.16%.

Contact Ulli