US equities closed mixed as investors remained worried about the debt ceiling negotiations and global economic growth while a rebound for Apple Inc buoyed the technology sector.

In economic news, the World Bank sharply cut its global growth forecast for this year citing austerity measures, low business confidence and high unemployment in advanced economies. The bank lowered its outlook for global economic growth to 2.4 percent from an earlier estimate of 3 percent.

Separately, the US Federal Reserve reported a rise in industrial production for the second straight month in December as demand for business equipment picked up even as lawmakers battled over the federal budget. Industrial production rose 0.3 percent in December after a 1 percent jump in November.

The US Fed’s Beige Book survey from 12 districts found rising home and car sales drove economic activity higher in December.

On a positive note, the Labor Department found consumer prices for goods and services held flat in December, with prices rising at an annual clip of 1.7 percent mostly due to a fall in gas prices.

Boeing got hit today and slumped 3.4 percent as aircraft maker’s 787 Dreamliner continued to face problems. Two of Japanese airlines grounded their fleets of Dreamliners following an emergency landing after pilots on a domestic flight of All Nippon Airways got battery-fault warnings and saw smoke in the cockpit.

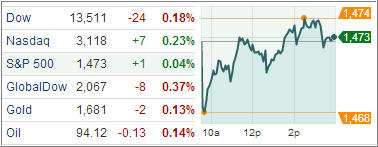

The S&P 500 Index (SPX) rose less than half a point with technology fronting the gains and telecommunications sliding the most among its 10 business groups.

Apple shares rallied 4.2 percent to reclaim the $500 level after slipping 7.2 percent over the previous three sessions. The firm introduced an installment payment plan in China to compete with low-cost device makers in the world’s largest market for computers and mobile phones.

Treasury prices rose, pushing yields down for a fourth day as concerns over the debt-ceiling gridlock between the President and lawmakers in Washington fueled demand for safe haven assets.

The US dollar held slim gains against the euro, slowing the pace of appreciation Wednesday, after the euro sank in the previous session following the comments of Jean-Claude Juncker, president of the Eurogroup.

Ewald Nowotny, Austria’s central bank governor and a member of the European Central Bank’s governing council disagreed with Juncker’s comment that the euro is “dangerously high” and said he doesn’t see any long-term upward trend of the shared currency.

European stocks meanwhile reversed early losses to close slightly higher today as optimism over higher US industrial production was tempered by World Bank’s downward revision of global economic growth.

It’s been pretty much a flat week, and our Trend Tracking Indexes (TTIs) followed that theme as the Domestic TTI moved to +2.84% while the International TTI settled at +9.93%.

The major market indexes appear to be bouncing against a glass ceiling and are in dire need of justification to break out to the upside. I doubt whether that will come from the earning season but these days you just don’t know how good or bad news are being interpreted when it comes to providing fuel for further market advances.

Contact Ulli