The ETF/No Load Fund Tracker—Monthly Review—December 31, 2012

The ETF/No Load Fund Tracker—Monthly Review—December 31, 2012

US Equities Rally Into 2013 On Fiscal Cliff Compromise

Thanks to emerging details of a budget deal that approved extension of tax-cuts for most households, US stocks rallied on the last trading day of the year on Monday, reinforcing yearly gains. Analysts believed stopping the tax increase would meaningfully reduce the prospect of recession in the first half of 2013.

The fiscal-cliff negotiations before the year-end deadline caused wild swings in the market. The Chicago Board Options Exchange Volatility Index, known as VIX, surged 11 percent on Friday, December 28, to 21.62, crossing above the 20 level for the first time since late July. The volatility index however slumped 16 percent on Monday after details of a possible budget deal emerged.

Meanwhile, economic data indicated long-term recovery for the economy, especially the housing market. Pending home sales rose 1.7 percent in November and though existing-home sales doesn’t directly impact homebuilders, strong sales does augur well for new constructions. Spending in US construction project, however, slipped unexpectedly in November, held back due to declines in non-residential and public works, a separate report revealed.

Political brinkmanship in Washington eroded consumer confidence in December with the University of Michigan’s Consumer Sentiment Survey reading falling to 72.9 from an initial point of 74.5.

Across the Atlantic, European stocks finished the year on multi-year highs.

The German economy is looking robust though economic expansion may slow down slightly this year. It’s the only large nation where unemployment, based on the Organization for Economic Cooperation and Development’s harmonized data, fell to six percent in 2011 from 8.4 percent in pre-crisis 2007. Unemployment rates doubled in the US, Spain and Greece; rose 50 percent in the UK, 20 percent in Japan, and 15 percent in France during the same period, OECD data reveals.

November’s sharp selloff following the elections stopped us out of our DVY position leaving us behind as the markets took off for the remainder of the year. It was uncertainty at its finest and, with the benefit of hindsight, a more aggressive equity stance would have served us better going into the New Year.

However, it’s important to note that the fiscal cliff issue could have pushed the markets into the other direction as well with possibly dire consequences, which is why I chose the conservative route. We now have to ease our way back into equities and some other bond holdings that have proven to be good performers in this market environment.

Having a portfolio balance is still critical as the next cliff in form of the debt ceiling debate is looming in the near future and has to be tackled by congress somewhere in late February or early March, which very likely will create extreme market volatility.

Adding to that is the fact that the European financial system is being held together by duct tape and a sudden blow up of one of the weaker banking systems (Greece, Spain) could end this euphoric bull market rally in a hurry. I have commented on that before, but have been proven wrong with my assumptions as politicians have continuously been able to come up with more creative ways to postpone the inevitable.

You may have been surprised at the strength in the equity markets. That is simply a result of the Fed printing some $85 billion per month, and that money has found a home in risk assets. We are at very elevated levels, and the benchmark S&P 500 index does in no way resemble economic reality.

That means we are floating on a bubble with not much support below, and I have to question the durability of this move, which is only supported by Fed’s reckless pumping of money into the system.

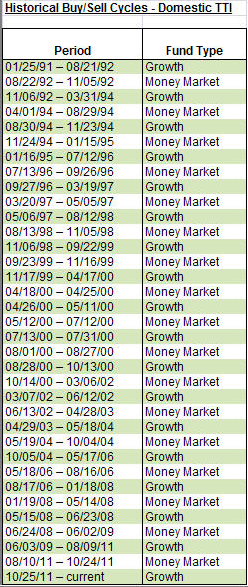

Nevertheless, our Trend Tracking Indexes (TTIs) continue to remain in a ‘buy’ mode, so I will start to nibble and carefully add dividend generating equity/bond positions as the New Year progresses.

Contact Ulli