US stocks advanced for the second straight day Thursday as Apple Inc bounced back from its biggest drop in nearly four years and technology stocks showed strength. But the gains were capped as investors avoided making big bets as long as a budget deal remained elusive in Washington.

The indexes continued in roller coaster mode pushed to the upside by renewed hope of more QE and pulled to the downside by underlying economic realities. Of course, the fiscal cliff hangs over the markets, and judging by the latest battle news, chances of a resolution are slim to none as the warring factions have dug in their heels.

I am not sure if Apple’s sharp drop yesterday was a harbinger of things to come, but as traders realize that odds are high that we might be going over the fiscal cliff, there is bound to be some heavy selling towards year end to lock in profits and close out positions as tax rates are sure to go up.

Major equity averages fell early on after European Central Bank President Mario Draghi revised economic growth downwards to minus 0.5 percent this year, more than the 0.4 percent contraction it had put out in September.

Draghi cut the central bank’s economic forecast to minus 0.3 percent in 2013 and projected a growth of 1.2 percent in 2014, adding risks to the outlook remain on the downside.

Separately, the Labor Department said that the number of Americans filing for first-time unemployment benefits dropped 25,000 to 370,000 last week, the least in a month.

Analysts expect the monthly unemployment rate to hold at 7.9 percent for November when the nonfarm payroll report is published tomorrow.

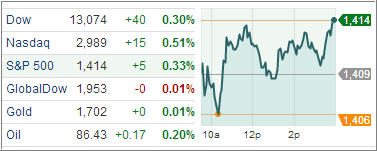

The Dow Jones Industrial Average (DJIA) gained 40 points while the the S&P 500 Index (SPX) added 5 points with technology fronting the gains and utilities performing the worst among its 10 major industry groups.

Treasuries advanced on Thursday, pushing yields to their lowest levels in more than two weeks as politicians debated the effects of tax hikes and spending cuts, AKA as the fiscal cliff, sustaining demand for safer assets.

The US dollar gained traction against the European unit after ECB President Mario Draghi lower the region’s growth forecast, boosting some analysts’ expectations of a rate cut in near future.

Meanwhile, European stock markets pushed higher, lifted by a 1.1 percent surge in the German DAX index. The equity benchmark settled at near five-year highs on the back of surprisingly strong factory order data.

Buoyed by the German benchmark’s performance, the pan-European Stoxx Europe 600 index rose 0.7 percent to 278.82, it highest level in 2013.

In the ETF space, commodity related funds, excluding gold and silver, tanked on Thursday. The United States Oil fund (USO) and the United States Natural Gas Fund (UNG) led the decliners after oil prices fell 1.8 percent to a one week low following the ECB’s lower growth projection for 2012 and ’13. USO trimmed 1.74 percent while UNG gave up 1.1 percent. The United States Brent Oil Fund (BNO) also slipped, shedding 1.52 percent for the day.

Our Trend Tracking Indexes (TTIs) tacked on slight gains with the Domestic TTI now printing at +1.93% while the International TTI sits at +5.40%.

For quick access to the most recent StatSheet including TTI charts and all momentum figures, click here. You can read the latest ETF Model Portfolio update here.

Contact Ulli