The ETF/No Load Fund Tracker—Monthly Review—November 30, 2012

Equity ETFs Finish November Mixed; Europe Heads Higher

US equity ETFs finished November modestly higher, but not before witnessing wild swings triggered by worries over the US fiscal cliff and developments in Europe. The tech-heavy NASDAQ and the smaller cap indices fared better than the large-cap S&P 500 and Dow Jones with the NASDAQ posting its first positive November since 2009.

The US economy continued to dish out mixed numbers. The November Chicago PMI reading, although coming in higher at 50.4 over the prior month’s 49.9, fell short of economists’ projections of 50.7.

Personal income remained unchanged in October and was well below the 0.2 percent increase analysts had predicted. As a result, personal spending data also remained weak, dropping by 0.2 percent versus the 0.1 percent uptick expected by economists.

The Dow Jones Industrial Average lost 0.5 percent for the month while the S&P 500 inched up a modest 0.3 percent.

The housing sector also sent out mixed signals. A report by the National Association of Realtors showed pending home sales jumped 5.2 percent in October, indicating significant improvement. New home sales however, declined 0.3 percent in October after clocking a 0.8 percent rise in the prior month. Analysts, nonetheless, believe the general trend indicates a slow but steady recovery.

With much economic uncertainty, and fallout from the elections, the major indexes tanked big time during the middle of the month but managed to recover before the selling got out of hand. Nevertheless, the downturn was sufficient in momentum to stop us out of our main equity holding, namely DVY, as it breached its long term trend line to the downside.

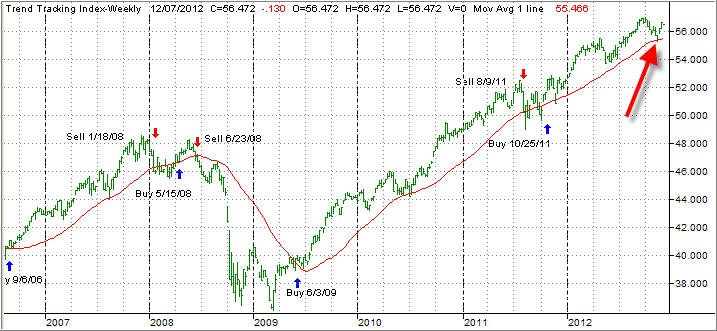

Additionally, it looked like a market breakdown was about to happen as our Domestic Trend Tracking Index (TTI) briefly dipped into negative territory before recovering. This dip was not a clear piercing of the trend line to the downside, so the all-out sell signal for equities was not generated. Here’s what the updated Domestic TTI looks like:

The red arrow points to the moment in time when the trend line was momentarily broken. The subsequent recovery was mainly attributed to hedge funds trying to engage in some month end window dressing as equities looked more attractive after the selloff.

Even though a report by the Commerce Department showed the US economy expanding at a faster annual clip of 2.7 percent in the third quarter, handily beating the initial 2 percent estimate, it may very likely get revised to the downside, which would more truly reflect the actual state of the alleged economic expansion.

Across the Atlantic, Paris losing its coveted AAA rating was one of the biggest developments for the month. The French downgrade by Moody’s impacted the region’s emergency bailout funds as well after the ratings agency cut both the European Stability Mechanism and the European Financial Stability Facility to Aa1 with negative outlook citing the high correlation in credit risk between the bailout funds and its largest supporters.

With the fiscal cliff looming large here in the US and Europe’s ever worsening debt issues not being addressed but merely sugar coated and actions being postponed, market volatility will be with us for a while. Depending on how the fiscal cliff saga plays out, I will seek exposure to equities again, very likely after the 1st of the year.

I can’t be absolutely sure yet, since we may have very well slipped to the bearish side of the Domestic TTI trend line by then. If markets should succumb to bearish forces, I will increase our bond exposure using BOND, which is PIMCO’s Total Return ETF. During 2012 it has given us enough back data for it to be considered investment material.

Actually, for the 9 months it’s been on the market, it has beaten its mutual fund cousin by a good margin, and I anticipate adding BOND to our holdings. My reasoning is that we are likely facing like a slow growth or muddle through scenario, which will benefit bonds and some dividend paying ETFs more than outright growth equities.

At least that’s what it looks like right now; should the major trends change, I will make adjustments accordingly.

Contact Ulli