Domestic stocks extended losses for the fourth straight session Thursday as investors weighed negative data on employment and manufacturing activity, and political uncertainties overseas.

A Labor Department report revealed 439,000 Americans filed for unemployment benefits last week, a sharp increase of 78,000 that analysts attributed to Hurricane Sandy while a separate monthly manufacturing survey by the Federal Reserve Bank of Philadelphia showed economic activity declined in November.

Also, manufacturing activity slowed down in the New York region this month as Hurricane Sandy disrupted power supply and curtailed activity, another report showed. Meanwhile, inflation remained subdued at 0.1 percent in October, the Consumer Price Index showed.

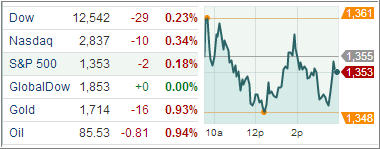

The major indexes were in negative territory for most of the day, but managed to cut losses during the last hour as the chart above shows.

Ahead of President Obama’s Friday meeting with Democratic and Republican lawmakers to avoid a deadlock in the upcoming budget session over tax hikes and spending cuts that may push the US into recession, Treasury 10-year notes rose for the sixth day, the longest stretch of gains since September.

European stocks declined on Thursday as latest data showed the single-currency region fell back into recession in the third quarter. Economic output shrank by 0.1 percent in the third quarter after declining by 0.2 percent in the previous quarter.

The Stoxx Europe 600 index fell 1 percent, dragged down by oil services provider SBM Offshore NV. The firm sank 13 percent after lowering revenue forecast for 2013.

The DAX 30 index slipped 0.8 percent in Frankfurt with software provider SAP AG tanking 1.4 percent.

The CAC 40 index also traded lower, shedding 0.5 percent in Paris. Electricite de France SA fell 2.1 percent after HSBC cut its rating to neutral from overweight.

London’s FTSE 100 index lost 0.8 percent, dragged down by energy firms. As oil futures slipped on Europe recession, shares of Royal Dutch Shell Plc eased 1 percent. Also BP Plc shed 0.1 percent after the oil major said it would pay about $4.5 billion to settle the 2010 Gulf of Mexico oil-spill charges.

In the ETF space, precious metal miners, especially gold mining funds got hammered as the yellow metal dropped below the $1,700 an ounce mark briefly in afternoon trade. The Van Eck Market Vectors Junior Gold Miners (GDXJ) crashed 4.12 percent due to heavy selling pressure.

Also, the United States Natural Gas Fund (UNG) tanked 1.59 percent after NG futures dropped from a one-year high after supply decline missed estimates.

Trend wise, momentum continues to weaken as our Domestic Trend Tracking Index (TTI) finally succumbed to selling pressure and closed below its long term trend line by a scant -0.10%.

That is not enough of a piercing to the downside to declare this Buy cycle from being over, however, most domestic equity ETFs/mutual funds have triggered their trailing sell stops by now, which is what you should focus on. Once the TTI finally breaks down further, it is merely a confirmation that we haved officially entered bear market territory.

The International TTI is still hanging on at +0.58% but, with a little more weakness, this index will break its trend line to the downside as well. Most international ETFs have triggered their sell stops, so you should have no exposure in that arena.

For quick access to the most recent StatSheet including TTI charts and all momentum figures, click here. You can read the latest ETF Model Portfolio update here.

Disclosure: No holdings in ETFs discussed above

Contact Ulli