The ETF/No Load Fund Tracker—Monthly Review—October 31, 2012

US Equity Averages Post First Monthly Loss Since May; Europe Manages Modest Gain In October

US equity averages finished lower for the first time since May, capping an otherwise lackluster month as markets turned cautious ahead of the Presidential and Congressional elections this week.

The economic indicators in October remained mixed even though the job market showed signs of sustained recovery. The nonfarm payrolls reading for October, the most important piece of economic data before the elections came in at 171,000, well above the 125,000 pace projected by most economists. Hiring in the previous two months also grew at a faster clip than estimated, the Labor Department report showed.

Unemployment rate, calculated separately through a survey of 60,000 households, ticked higher to 7.9 percent in October from 7.8 percent in the previous month, meeting expectations. Analysts cited a jump in labor force participation rate for the uptick. Factory orders also rose 4.8 percent in September after shrinking 5.2 percent in August, a separate report showed.

The Dow Jones Industrial Average was off 2.5 percent for the month while the S&P 500 Index shed two percent. The tech-heavy NASDAQ Composite Index sank 4.5 percent.

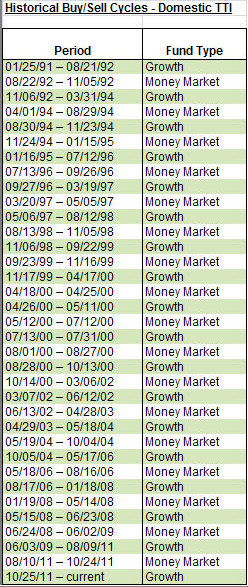

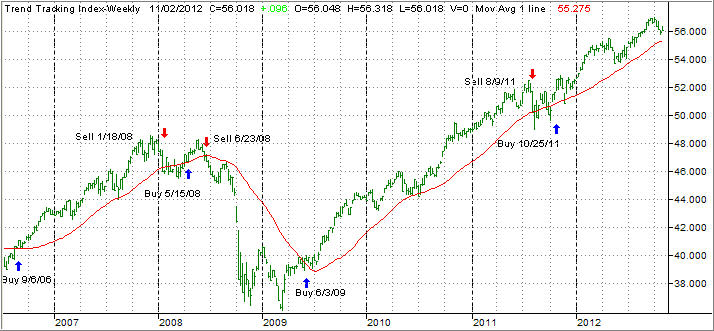

Our main directional guide, the Domestic Trend Tracking Index (TTI) meandered with the markets but remained on the bullish side of the trend line by a meager +1.34% as the chart shows:

Whether there is enough upward momentum left to keep us from breaking below the line and into bear market territory remains the big unknown.

As I have posted frequently, the entire move in the stock market during this year was attributable to the Fed’s QE (Quantitative Easing) effort. In other words, the underlying economic activity does not reflect what the levels of the various stock indexes are telling us. Of all entities, the NY Fed admitted that had not been for these various stimulus programs over the past few years, the S&P 500 would be hovering at 600 and not at the current value of slightly above 1,400.

Even powerhouse Goldman Sachs has not yet adjusted its 1,250 year end forecast of the S&P 500. If that were to happen, it would mean a drop in the index of over 10% between now and year end, which would wipe out all profits for the buy and hold folks.

Another fact is that much of the economic data points over the past couple of months may have been “massaged” in view of the upcoming elections. I am not making any accusations here, but many reports support this viewpoint.

Additionally, the White House has asked Europe not to make any drastic decisions prior to the elections (the Troika report on Greece comes to mind). Other details are unknown, but it is obvious that some actions may have been postponed to be dealt with after November 6.

My current view is that no matter who wins on election Tuesday, there will be a relief rally mainly due to the fact that a winner has been clearly established and this endless jawboning is finally over. That could be a short lived move, as we now need to face reality in terms of Europe’s ever worsening debt issues, the debt ceiling and the looming fiscal cliff.

In regards to Europe, November promises to be an eventful month for the continent as both Greece and Cyprus are expected to run out of cash by the middle of the month. The parliaments of Athens and Nicosia are yet to approve further spending cuts. Once approved, Chancellor Angela Merkel will present them in the Bundestag, hoping German lawmakers will pass them to open up emergency aid to the debt-stricken countries.

A formal announcement confirming support is expected to be made when EZ leaders meet in Brussels on November 12, barely a week from now. However, don’t be surprised if either or both countries are eased out of the currency union in near future, which leaves Spain as the next disaster to be dealt with.

If so, the impact will be felt worldwide, as the dominos finally begin to fall; market reaction will be swift and to the downside.

I don’t know yet, how this will all play out, but we will take no chances and be prepared to liquidate those positions that are affected by a change a market direction. As always, our sell stops are ready to be executed when necessary.

Contact Ulli