Giving out early session gain gains, US stocks finished lower Wednesday as the Federal Reserve’s call for modest growth tempered moods amid signs of improvement in Chinese factory output and American housing market.

October US flash manufacturing activity notched up to 51.31 from 51.1 in September while the US housing industry continued to chug ahead, extending gains in September. A Commerce Department report revealed new-home sales jumped 5.7 percent to a 389,000 annual pace in September, the highest since April 2010.

Also, the initial HSBC China Manufacturing Purchasing Managers Index rose to 49.1 in October from 47.9 in September, a three-month high that indicated the economic contraction may have bottomed out in the country, adding to the temporary “soft landing” theory.

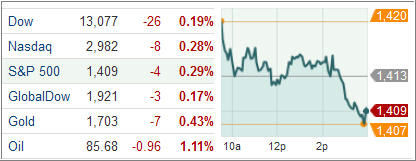

The Dow Jones Industrial Average (DJIA) closed 25 points lower, despite rising 52 points in intraday trade. The 30-component blue-chip index turned positive with all but eight stocks finishing lower for the day.

The S&P 500 Index (SPX) trimmed 4 points with utilities taking the biggest hit and healthcare surging the most among its 10 business sectors.

US Treasuries pared early losses Wednesday after the Federal Reserve ended its two-day policy-setting meeting without altering its interest rate forecast or bond purchase program. The central bank warned the economic recovery was modest while unemployment remained elevated.

The benchmark 10-year Treasury yields rose one basis point to 1.77 percent while yield on 30-year Treasury bonds jumped five basis points to 2.95 percent.

The US dollar meanwhile made modest gains Wednesday after the Federal Reserve kept its economic outlook unchanged. The ICE dollar index, a measure of the greenback’s strength against a basket of six global currencies, rose to 79.932 from late Tuesday’s 79.922.

European stocks pushed higher after encouraging Chinese factory data and strong US housing number offset the region’s own dismal economic indicators. The pan-European Stoxx Europe 600 index rose 0.4 percent, recovering some ground after Tuesday’s steep 1.7 percent decline.

The Markit Initial Composite Purchasing Managers Index for the eurozone dropped to a 40-month low of 45.8 in October from 46.1 in September. Germany’s manufacturing PMI fell to a two-month low in October while the business-climate measuring Ifo index reading for October came in softer than expected. Analysts however remained optimistic the eurozone industrial production may not contract further in the third quarter.

In Frankfurt, the DAX 30 index rose 0.3 percent, lifted by Volkswagen AG. The carmaker jumped 3.1 percent after it said 2012 sales may exceed previous projections.

In Paris, the CAC 40 index climbed 0.6 percent, helped by a 3.7 percent gain in S T Microelectronics NV. The chipmaker forecasted better revenue and higher gross margins in the second half of the year.

In the ETF space, China-linked funds outperformed the markets after latest PMI data indicated the country’s manufacturing may have found a bottom. The SPDR S&P China ETF (GXC) gained 1.32 percent after manufacturing output hit a three month high.

The Global X Social Media Index Fund (SOCL) also made progress today, adding 2.30 percent after Facebook shares jumped 19 percent. The United States Natural Gas Fund (UNG) was among the biggest decliners, shedding 2.07 percent ahead of tomorrow’s EIA inventory report. NG futures settled 2.4 percent lower Wednesday on foggy weather outlook.

Our Trend Tracking Indexes (TTIs) retreated further and closed the day with the following positions:

Domestic TTI: +1.09%

International TTI: +2.92%

Disclosure: No holdings in ETFs discussed above

Contact Ulli