US stocks turned lower Thursday falling for the first time this week as tech giant Google missed earnings target highlighting the storm brewing in the tech sector while a rise in weekly jobless rate eclipsed upbeat manufacturing data.

The mood went sour after a Labor Department showed initial jobless claims jumped 46,000 to 388,000, reversing a previous report that showed jobless rate tumbled to a four-year low in a seasonal quirk. Equities however, came off session lows after a Federal Reserve Bank of Philadelphia report revealed manufacturing bounced back in October while a separate Conference Board’s index of economic indicators climbed 0.6 percent in September.

Despite some very marginal and some extremely poor earnings reports and other data points, the markets did not head south as much as you might have expected. Why is it that we seem to continuously manage to regain early losses later on in the day?

Mark Grant, author of ‘Outside the Box’, had this to say:

I have often heard it asked, and by some of the largest professional money managers in the world, why the markets are behaving in their current fashion. We get bad economic news, poor earnings, fiscal crisis in Greece, Spain, Ireland, Portugal, Cyprus and perhaps in Italy and still the markets rise.

The reason for all of this is “intervention” which has resulted not just in liquidity but in the notion that the central banks will do anything/everything to cure the problems so that worse is better, white is black and rational judgment is transformed into lunacy. It is liquidity and faith that are driving the boat and derelict accounting that is providing the fuel.

This goes very much along with my way of thinking as the markets are now centrally planned and affected by seemingly only the words and the intentions of the Fed. How long this phenomenon can last is anyone’s guess.

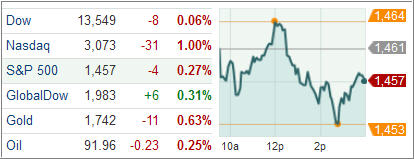

Be that as it may, the Dow Jones Industrial Average (DJIA) trimmed 8 points while the S&P 500 Index (SPX) shed 4 points with technology faring the worst and telecommunications pacing the gains among its 10 business groups.

The NASDAQ Composite Index (COMP) plunged 31 points, led by search-engine leader Google (GOOG). The tech-giant’s shares tripped eight percent after third quarter earnings and revenue missed targets. Financial results were accidentally released during regular trading hours with Google blaming RR Donnelley & Sons (RRD) for releasing a draft of the Q3 results without permission.

Treasuries closed nearly flat even as the yield on 10-year notes touched a one month high after differences over pooling of euro-area debt – supported by France, Italy and Spain, and rejected by Angela Merkel, came out in the open.

The US dollar, meanwhile, gained ground as risk sentiment eased after US weekly jobless claims proved that the recovery of the labor market remains weak.

European stocks hit a sixteen month high Thursday in a volatile trading session after a mixed bag of US economic data and earnings report sent indexes swinging between gains and losses. The pan-European Stoxx Europe 600 index climbed 0.2 percent to post its fourth straight session of gains.

Data from China also weighed on investors as the country’s third quarter GDP grew by 7.4 percent, down from 7.6 percent in the second quarter. September data from the world’s second largest economy, however, showed a pickup, indicating the economic slowdown may have bottomed out.

The FTSE 100 index rose 0.1 percent, lifted by miners Rio Tinto Plc and BHP Billiton Plc. The DAX 30 index gained 0.6 percent after ThyssenKrupp AG added 1 percent in Frankfurt and the CAC 40 index rose 0.2 percent higher in Paris, lifted by a 2.5 percent gain in Societe Generale SA.

The Spanish IBEX 35, however, slipped 0.3 percent, dragged down by Banco Santander.

In the ETF space, commodity linked funds headed higher. The United States Natural Gas Fund (UNG) was one of the best performers as natural gas futures pushed ahead. The weekly NG inventory report came in higher than expected; still UNG finished up 2.64 percent.

Agricultural commodities also turned higher as adverse weather conditions hit Brazil and Argentina. The Soybean Fund (SOYB) ended 2.02 percent higher while the Corn Fund (CORN) added 1.60 percent.

For the latest momentum numbers and Trend Tracking Index (TTI) positions, please see the updated StatSheet, which I will post shortly.

Disclosure: No holdings

Contact Ulli

Comments 3

Ulli,

I am just curious why if your trend tracking has broken out to the upside, you continuously show “no holdings”. Does this mean that for all the accounts you manage you have stayed in cash?

Thanks in advance,

Chuck

Chuck,

Hmm, you are missing the point. When I write an article and mention specific ETFs by name, I am obliged by law to disclose whether I own this security or not. So, it’s simply a disclosure, which has nothing to do with the actual holdings I own. Sometimes, when discussing an ETF that I do have a position in, I will mention that as well.

Ulli…

It is crazy that the market bounces back, fairly quickly, seemingly irregardless of recent bad news. I just follow the trend, rather than try to second-guess the news and what the market’s reaction to the news is going to be. Right now, the trend seems to be sideways. For an options trader, like me, that means use spreads or get out.