The ETF/No Load Fund Tracker—Monthly Review—September 30, 2012

The ETF/No Load Fund Tracker—Monthly Review—September 30, 2012

US Markets Eye Jobs Data In The Final Quarter As Fed Stimulus Shows Signs Of Fading

US stocks traded lower in the final days of an otherwise blockbuster quarter, as markets stepped back to analyze some of the QE3 inspired gains.

The disappointing September Chicago PMI was the immediate trigger as the gauge slipped into the contradictory region of 49.7 from 53 in August. Weakness in the automobile sector and everything associated with it were blamed for the decline.

The month’s biggest event however, remained the Federal Reserve’s decision to widen its assets purchase program to boost the economy. On September 13, Chairman Bernanke announced plans to buy additional agency mortgage-backed securities at a pace of $40 billion per month, informally known as QE3, lifting the S&P by 1.6 percent.

The Fed is already running the ‘Operation Twist’ program where it buys $45 billion in longer term debts every month to bring down long-term borrowing costs.

Economic data remained mixed for the month. On the positive side, personal spending grew by 0.5 percent in August, meeting expectations. Weekly jobless claims also continued to slide with the initial reading falling by 26,000 to 359,000 in the final week, the lowest since July, indicating some much-needed improvement in the labor market. The housing sector continued to improve with existing home sales surging to a seasonally-adjusted annual rate of 4.82 million in August.

On the flip side, personal income rose by 0.1 percent in September, falling short of the projected 0.2 percent growth. Also, the University of Michigan’s consumer sentiment survey for September dropped to 78.3 from a preliminary estimate of 79.2. Elsewhere, durable goods order declined 13.2 percent in August while the final iteration of Q2 GDP growth came in lower at 1.3 percent.

The Dow Industrials added 2.7 percent in September and 4.3 percent for the quarter. The S&P 500 rose 2.4 percent for the month and 5.8 percent for the quarter while the tech-heavy NASDAQ Composite Index added 1.6 percent for the month and 6.2 percent for the quarter.

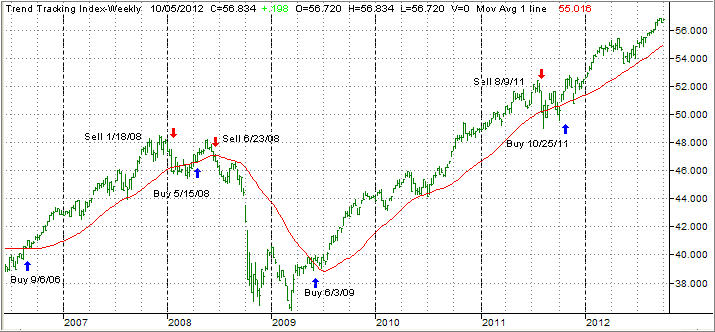

Our main directional guide, the Domestic Trend Tracking Index (TTI) inched higher from last month as the chart below shows:

Europe remained in the news with Spain stealing the spotlight for better part of the month, as it dragged its feet over formally seeking a bailout from its neighbors. Secessionist tendencies flared up with one of the most indebted region Catalonia demanding more control over revenues it generated while violent street protests against austerity measures erupted across the country. Even though the country’s unemployment rate remains above the 20 percent mark, it’s important to note the effects of austerity is yet take shape.

Stress-tests conducted across Spanish banks showed the country would require EUR 59.3 billion (if you can really believe these test results) to recapitalize its struggling lenders, bringing some relief to the markets. Madrid has already received commitments worth EUR 100 billion from the EU for strengthening the balance-sheets of its cajas, aimed at restoring investor confidence.

However, the relief proved fleeting as the government’s report was contested for being too liberal with Nomura Securities and JP Morgan putting the recapitalization estimates between EUR 94 billion and EUR 112 billion.

The pan-European Stoxx Europe 600 index rose an impressive 6.9 percent for the quarter. The French budget for 2013 received much attention after socialist President Francois Hollande raised the income tax rate to 75 percent for individuals earning over EUR 1 million annually. Paris hopes to mop up an additional EUR 30 billion in revenues through the new measures, which are doomed to fail considering that France’s economy is skating on thin ice.

I have mentioned it before in some of my daily blog posts but it bears repeating. The domestic equity market, as measured by the S&P 500, is totally out of sync with underlying economic fundamentals. The only reason that the index is at the current elevated level is because of the Fed’s various stimulation efforts. Even the NY Fed has admitted that the S&P 500 would be hovering at the 600 level (and not at 1,450) if it had not been for all of the QE programs of the past few years.

The latest QE-3 will do nothing for the economy and certainly not much to improve unemployment. It will, however, add to inflationary pressures long-term, which is why I added some exposure to gold (GLD) to our holdings during the month of September.

Given the uncertainty about the upcoming elections, the debt ceiling, Europe’s issues as well as the fiscal cliff, being alert to the fact that things can change in a hurry makes me very cautious when it comes to my investment outlook.

We have entered uncharted territory given the Fed’s policies, which means to me that our trailing sell stops are of vital importance at the very moment the daily “lift-a-thon” of the indexes comes to an end, and reality puts the bears in charge again. Nobody knows when this event will occur, but we are prepared to exit those positions affected by a sudden turnaround.

This is the time to be more concerned with the return of our capital then the return on our capital.

Contact Ulli