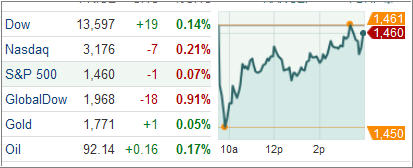

US equities mostly closed lower even as blue-chip stocks managed to cling onto modest gains after economic reports from the US, China, Japan and Europe increased concern the global economic recovery is worsening.

Chinese manufacturing slowed down for the 11th straight month in September after a HSBC preliminary purchasing manager’s index reading ticked up slightly to 47.8 from 47.6 in August, while a separate report showed services and manufacturing in Europe slumped to a 39 month low in September.

In the US, first-time jobless claims dropped by 3,000 to 382,000 last week, staying above 375,000 estimated by economists at MarketWatch. A Philadelphia Federal Reserve Bank report showed manufacturing in the region improved slightly with its business-conditions index rising to negative 1.9 from negative 7.1 in August.

Treasuries erased losses following the Federal Reserve’s announcement last week as government debts advanced for the fourth straight day. The benchmark 10-year Treasury yield finished one basis point lower at 1.77 percent despite falling as low as 1.72 percent during the session. 30-year Treasury bond yields shed 1 basis point to settle at 2.96 percent.

The US dollar gathered momentum Thursday after weak economic data from China and Europe soured investor sentiment. The dollar index, a barometer of the greenback’s strength against a basket of six leading currencies, rose to 79.428 from 79.113 in late North American trade on Wednesday.

Meanwhile, amid weak global economic data, stocks tumbled Thursday in Europe as investors looked for clues where the economy is headed. The pan-European Stoxx Europe 600 index shed 0.2 percent as banks and resource firms weighed on the benchmark.

In London, the FTSE 100 shed 0.6 percent after most metal prices slipped following weak Chinese manufacturing data.

Focus also shifted on Spain after Madrid raised EUR 4.8 billion (USD 6.22 billion) in three year government security auctions at a slightly elevated cost. 10-year borrowing costs moved lower to 5.666 percent in today’s auction while 10-year bonds traded at 5.75 percent in the secondary market.

Weighed down by banks, Spain’s IBEX 35 index closed one percent lower. In Frankfurt, the DAX 30 index shed 0.02 percent after Commerzbank AG and Deutsche Bank AG slipped 4.1 percent and 1.1 percent respectively.

In Paris, the CAC 40 index fell 0.6 percent after BNP Paribas lost 1.5 percent.

All in all, the global slowdown continuous its relentless march, although looking at the S&P 500, you wouldn’t know it. Despite all of the Fed’s manipulation efforts, it’s inevitable that reality is bound to set in at some time; the timing of it is the big unknown.

In the ETF space, China-linked ETFs got hammered after manufacturing shrank for the 11th month in a row. The SPDR S&P China ETF (GXC) shed 1.31 percent. The MSCI Japan Index Fund (EWJ) also weakened, slipping 1.06 percent as exports declined in August due to weak global demand.

On the domestic front, the iShares Dow Jones Transportation Average Index Fund (IYT) sank 2.82 percent as rail operator Norfolk Southern sank 9.66 percent.

Please see latest StatSheet, which I will post within the hour, for the latest momentum figures and Trend Tracking Index updates.

Disclosure: No holdings

Contact Ulli

Comments 2

As always thanks for your opinion- it is appreciated!

Freden,

Again, there are many ways to enter the market. The one that matters most, and the one you should use, is the one the matches your risk tolerance. After all, if you are not comfortable, stay out! We are at high market levels and, given the global economic slowdown, which has not been discounted by the markets, the downside risk is far greater than the upside potential.

Ulli…