US stocks bounced back Thursday with the S&P 500 snapping its five-day losing streak after Spain officially released its 2013 budget outlining more spending cuts than tax hikes, a move seen by markets as a key development before the debt stricken country formally seeks ECB intervention.

Risk sentiment was boosted further after last week’s initial jobless claim improved to 359,000, the lowest since July while a revised Labor Department report separately showed the economy added 386,000 more jobs between March 2011 and March 2012 than previously estimated.

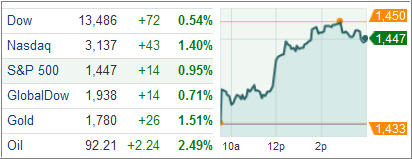

After rising over 109 points, the Dow Jones Industrial Average (DJIA) finished 72 points higher while the S&P 500 Index (SPX) rose 14 points, reversing its longest down streak since July. All business groups but utilities within its 10-sector index closed higher with financial, technology and energy pacing the gainers.

I am sure that quarter ending window dressing by fund managers had some influence on today’s rebound; the open question remains as to how much upside is left given the very questionable economic data points.

Following an uninterrupted nine-day rally, Treasuries declined Thursday as Spain presented its budget for 2013, taking an important step towards reducing its budget deficit.

Yield on the benchmark 10-year Treasury notes jumped five basis points to 1.65 percent while yield on 30-year Treasury bonds surged six basis points to 2.84 percent.

The euro finished the day higher after a volatile trading session with the EUR/USD pair hitting a high of 1.2912 following Spanish budget announcement. The dollar index, a gauge of the greenback’s strength against a basket of six global peers, fell to 79.560.

Meanwhile, across the Atlantic, European stocks finished in the green after seesawing rbetween losses and gains in a choppy trading session. The pan-European Stoxx Europe 600 index rose 0.3 percent after Spain agreed to an additional EUR 40 billion in spending cuts in 2013, exceeding market expectations of a EUR 39 billion cut. The government also plans to borrow EUR 3 billion from the country’s pension reserve to cover some Treasury obligations, said Deputy Prime Minister Soraya Santamaria de Saenz.

While 10-year Spanish yield dropped to 5.92 percent, the IBEX 35 equity index lost o.2 percent.

After yesterday’s rout, Deutsche Bank rose 1.3 percent in Frankfurt. The DAX 30 index rose 0.2 percent, helped by utility firm RWE AG.

In France, the CAC 40 index climbed 0.7 percent aided by banks Societe Generale and Credit Agricole.

In London, the FTSE 100 index was up 0.2 percent after resource firms rallied on hopes of market-boosting measures from China.

In the ETF space, precious metals-linked funds surged following Spain’s announcement. While gold flew to a seven-month high, the Van Eck Market Vectors Junior Gold Miners ETF (GDXJ) vaulted an impressive 5.31 percent.

As energy prices recovered with oil prices hovering around $92/barrel on Iran tensions, both the United States Oil Fund (USO) and the United States Natural Gas Fund (UNG) finished the day higher, adding 2.43 percent and 2.83 percent, respectively.

For all Trend Tracking Index positions and momentum numbers, please refer to the latest StatSheet due out later tonight.

Disclosure: No holdings

Contact Ulli