As violent protests march through Europe, major US ETF stock indexes retreated Wednesday with the S&P 500 tumbling for the fifth day in a row as investors moved to the sidelines and cut exposure in equities.

Markets were spooked following media reports that Catalonian President Artur Mas called for early elections yesterday during with an eye for independence from Madrid. Back home, a Commerce Department report showed new home sales dipped 0.3 percent in August to a 373,000 annual pace, still near a two-year high.

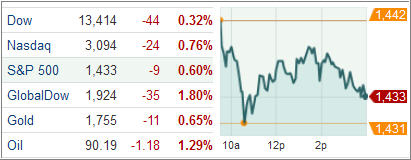

Extending losses for the fourth straight session, the Dow Jones Industrial Average (DJIA) shed 44 points while the S&P 500 Index (SPX) slipped 8 points faring the worst. Only utilities gained among the index’s 10 major business groups. Despite its latest streak of losses, the S&P 500 is up 2.5 percent for the month and 5.4 percent for the quarter ending Friday.

Amid increasingly violent anti-austerity protests in Greece and Spain, investors sought refuge in US Treasuries, pushing safe haven assets up for the eighth day, the longest up period since December 2008. Benchmark 10-year Treasury yields dropped five basis points to 1.61 percent while yield on 30-year Treasury bonds dropped six basis points to 2.79 percent.

The greenback meanwhile rallied against most global currencies after giving up some early gains briefly following today’s weak housing data. The dollar index, a barometer of the USD’s strength against a basket of six leading currencies, rose to 79.840 from 79.673.

Across the Atlantic, European stocks tumbled while Spanish 10-year bond yields rose above the six percent level as Europe continued to face political uncertainties over fighting its debt crisis. The pan-European Stoxx Europe 600 index plunged 1.8 percent to hit its lowest since September 5 – the day before ECB President Draghi announced plans to buy sovereign bonds from the secondary markets.

It is perhaps ironic that when Germans are criticized for refusing to bankroll the peripheries any more, rich Spaniards are getting increasingly reluctant to help out their less economically well off countrymen. Catalonia transfers economic output worth EUR 15 billion annually to the rest of Spain. The country’s 10-year borrowing costs vaulted 31 basis points to 6.03 percent, the highest in three weeks.

Led by banking stocks, Spain’s IBEX 35 index sunk 3.9 percent, the highest in Europe on Wednesday. Banco Santander SA tumbled 4.5 percent.

Germany’s DAX 30 index lost 2 percent as risk sensitive sectors like banks and resource firms led the decliners. Deutsche Bank sank 6.5 percent while Commerzbank AG plunged 5.7 percent.

In Paris, the CAC 40 index lost 2.8 percent, dragged down by mostly banks.

In London, the FTSE 100 index lost 1.6 percent, weighed down by banks, oil and metal firms.

In the ETF space, Treasury-linked funds continue to march ahead as investors reallocate assets amid growing tensions in Europe. The Vanguard Extended Duration Treasury ETF (EDV) surged 1.74 percent while the PIMCO 25+ Year Zero Coupon US Treasury Index Fund (ZROZ) rose 1.59 percent.

Our Trend Tracking Indexes (TTIs) headed lower with the overall market but remain on the bullish side of the trend line. You can view the latest details in tomorrow’s StatSheet, which will be posted around 6 pm.

Disclosure: No holdings

Contact Ulli