The ETF/No Load Fund Tracker—Monthly Review—August 31, 2012

Europe Still Wavering; In Search Of Direction From Central Banks

US equity ETFs ended higher despite a quiet and boring August with all three leading indexes gaining for the month.

Not surprising, the QE addicted crowd was left a little disappointed on the last trading day of the month, as Fed Chairman Ben Bernanke skipped any explicit mention of QE3 at the annual economic symposium in Jackson Hole, even though he sounded dovish and said the economy failed to add net new jobs since January and labor market stagnation remained a “grave concern.”

He, however, pointed out that “nontraditional policies” may be explored if the situation warrants, hinting at future Fed intervention if the economy fails to fire.

The Dow Jones Industrial Average (DJIA) finished the month 0.6 percent higher while the S&P 500 (SPX) added 2 percent for August.

Meanwhile, the US economy continued to churn out mixed data, as the August consumer confidence reading came in at 60.6, the lowest in nine months.

European stocks rallied on the month’s final session with the pan-European Stoxx Europe 600 index finishing August 1.9 percent higher even though the unemployment rate hit rate an all-time high of 11.3 percent while inflation paced to 2.6 percent from 2.4 percent in the prior month.

The rally was supported by media reports that quoted Governing Council member Benoit Coeure stating the ECB is working on a way to intervene in the bond market, particularly in the short-maturity segment. Sure, that sounds like another attempt to mask the real problem of solvency by providing more liquidity.

Meanwhile, Germany showed signs of a slowdown in August with unemployment rising. Markets were rattled on Thursday, August 30 after Slovak Prime Minister Robert Fico said chances of the euro breaking up are 50:50.

In a related development, German chancellor Angela Merkel supported Greece’s continuation in the currency union but strongly disapproved of leveraging the region’s emergency lending fund, the European Stability Mechanism, for buying Spanish and Italian bonds from the primary markets to bring borrowing costs down, contending such measures would violate the Maastricht Treaty.

She, however, backed ECB President Mario Draghi’s plan to intervene in the secondary bond market even though media reports suggested German Bundesbank chief Jens Weidmann considered resigning several times due to his opposition to Draghi’s plan. Draghi had favored “exceptional measures” in an article in the German newspaper Die Zeit citing price stability. Weidmann said decisions to fund governments by printing money should be taken up by parliaments instead of central banks and warned such measures may prove addictive “like a drug” for profligate states.

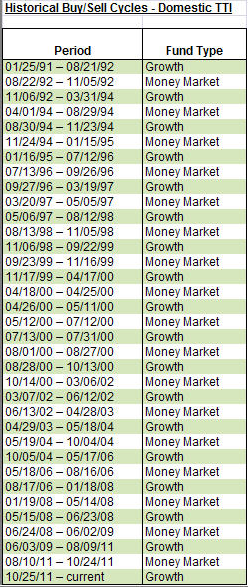

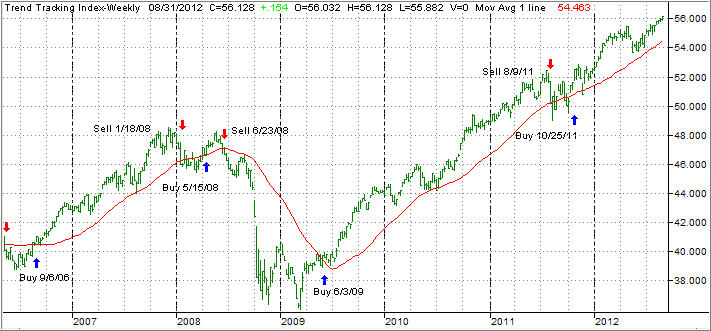

As far as the major domestic trend is concerned, our Domestic Trend Tracking Index (TTI) closed out the month hovering +3.06% above its long term trend line, as the chart below shows:

That means we remain clearly on the bullish side, and I have added some more exposure for new accounts to the conservative and dividend yielding ETF DVY (current yield is 3.4%), which has proven itself this year to add some stability to our portfolios as opposed to the Total Stock Market Index (VTI), which we had very limited holdings in.

With markets reacting no longer to bad or good news, but only to rumors as to what the Fed will do next, less volatile holdings are the way to go, especially in view of the fact that the economies not only in Europe but globally as well are worsening by the week.

With all eyes being focused on the Fed, or in Europe’s case on the latest word from the ECB, trends can easily reverse all of a sudden if one of these central planners disappoints or surprises.

This happened on the international side, as our International Trend Tracking Index (TTI) confirms:

Our latest Buy signal lasted from 2/8/12 until 5/15/12; then a reversal kicked in and a new ‘Buy’ was generated on 8/21/12. It is clear that short-term signals like these confirm the uncertainty in the rest of the world, which is why I sidestepped this one so far.

Remember, with Europe slowly falling apart, the United States is still the cleanest shirt in the global dirty laundry basket, which means, when things go bad, capital flight at this point will be into the U.S. supporting bond holdings and to some degree equities.

How long that will last is anyone’s guess. With politicians and central banks on both sides of the Atlantic being convinced that the underlying problem of too much debt can be resolved by issuing more debt, it’s only a matter of time until unforeseen consequences will affect market forces.

The timing of it is the big unknown, but I believe that there is a limit to the fine art of can kicking, so we are prepared to liquidate, should all of sudden the trend reverse so that we make it through the exit doors before they become too crowded.

Contact Ulli