The major indexes finished Wednesday with slim gains after the Federal Reserve’s Beige Book showed the US economy grew gradually across 12 districts with improving service-sector and retail activity offset by weak manufacturing.

On another dull August trading day, stocks remained largely range-bound after the release of mixed economic reports on the day. A Commerce Department report showed the US economy expanded at 1.7 percent in the second quarter, more than the previous estimate of 1.5 percent, while a separate report from the National Association of Realtors showed pending home sales jumped 2.4 percent in July, their highest level in two years, when a home-buyer tax-credit was set to expire.

While not overwhelming, economic data paint a picture of some improvement, which may be disappointing to those looking for an all-out QE 3 commitment by the the Fed’s

Bernanke during his upcoming speech on Friday. Personally, I think that he will disappoint the QE addicts, since I simply can’t see a major announcement with the economy chugging along while the market indexes are hovering multi-year highs.

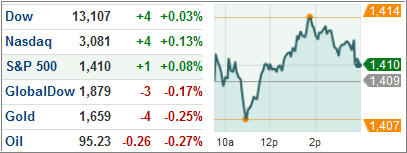

The Dow Jones Industrial Average (DJIA) finished 4 points higher, after a range of 64 points, snapping a three-day losing streak. Within the Dow, the breadth turned negative with 19 of 30 stocks closing lower.

Also reversing a three-day losing streak, the S&P 500 Index (SPX) rose 1 point to with telecommunications gaining the most and energy faring the worst among its 10 business groups.

Treasuries fell for the first time in three days, pushing the benchmark 10-year Treasury yield higher two basis points to 1.65 percent while yield on the 30-year Treasury bonds also rose two basis points to 2.77 percent.

The dollar remained strong against the euro Wednesday as traders digested economic data and anecdotes from the Federal Reserve for hints of further assets purchase by the central bank. The dollar index, an indicator of the greenback’s strength against a basket of six global currencies, rose slightly.

Germany’s DAX 30 index added 0.1 percent on the day. Chemical firm Linde AG rose 0.5 percent after Exane BNP Paribas hiked its target price by 0.5 percent.

Miners and banks pulled down the benchmark FTSE 100 index lower in London. Falling metal prices weighed on miners Rio Tinto and BHP Billiton.

France’s Societe Generale SA slipped 0.7 percent after the bank said it’s trying to sell its Greek unit Geniki to Greece’s Piraeus Bank SA. Cosmetics firm L’Oreal SA sank 4.38 percent its operating margin shrank even though earnings jumped 12 percent. France’s CAC 40 index lost 0.5 percent on the day.

German chancellor Angela Merkel renewed her opposition to suggestions of granting the region’s bailout fund, the European Stability Mechanism, a banking license arguing such a move will violate European Union treaties. ECB President Mario Draghi has already opposed leveraging the rescue funds firepower saying such measures are prohibited under current laws. In other words, nothing has changed and nothing can be agreed on.

In the ETF space, the iPath Exchange Traded Notes Dow Jones – AIG Grains Total Return Sub-Index ETN Series-A (JJG) jumped 2.41 percent after wheat and corn broke a five-day slide over fears that Russia, a big exporter of wheat, may curb shipments following drought in the country that may spike demand for US wheat.

The iPath Exchange Traded Notes Dow Jones – AIG Agriculture Total Return Sub-Index ETN Series-A (JJA) and the Teucrium Corn Fund (CORN) also rose, adding 1.79 and 1.44 percent, respectively.

With Bernanke’s speech on Friday looming large, I expect another slow trading day tomorrow. Enjoy the current lack of volatility as it may change in a hurry come Friday.

Disclosure: No holdings

Contact Ulli