US stocks finished lower Monday, extending their losing streak for the third straight day as investors became jittery on worries that profits will fall compared to the first quarter after Corporate America lowered earnings forecast as the second quarter earnings season takes off.

US government debt rallied led by the 30-year bonds as Italy’s 10-year bond yields remained above six percent and Spanish 10-year borrowing costs rose over seven percent, touching the danger zone, which boosted demand for safe-haven assets.

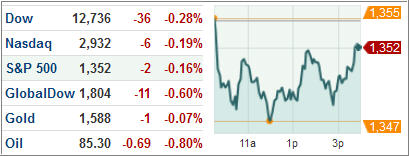

The Dow Jones Industrial Average (DJIA) shed 0.3 percent, off about 207 points in the last three down sessions. The S&P 500 Index (SPX) shed 0.2 percent with natural resources faring the worst and health-care topping the charts among its 10 industry groups.

On the back of Friday’s weak employment data, the benchmark 10-year Treasury yields dropped the most in more than a month as investors speculated/hoped the Federal Reserve will restart its quantitative easing program at its August 1 policy meeting.

In the meantime, German chancellor Merkel was observed to have been involved in some talks during the Wimbledon tennis tournament, at least according to down-under Comedians Clarke & Dawe:

ETFs in the news:

US stocks faced a choppy session on the first trading day of the week. However, commodities across the board, except livestock, advanced for the day. While cattle feeder futures dropped 1.7 percent, natural gas rallied more than four percent while corn vaulted 5.3 percent for the day.

The Teucrium Corn Fund (CORN) jumped 5.01 percent while other agriculture funds like the UBS E-TRACS CMCI Agriculture Total Return ETN (UAG) also made solid gains, adding 4.06 percent for the day.

Among the energy commodity funds, the United States Natural Gas Fund (UNG) remained among the day’s top performers, adding 3.58 percent for the day.

The iShares MSCI China Index Fund (MCHI) dropped 1.30 percent for the day after latest data from China showed the country’s inflation dropped to its lowest in two years in June, stoking fears of a slowdown.

The Shanghai Composite Index dropped to its six-month low as financial, automobile and resource stocks got hammered the most. However, a lower inflation rate, if you can believe the data, gives the Chinese central bank more headroom to initiate monetary easing measures to hopefully reverse the economic slowdown.

Disclosure: No holdings

Contact Ulli