The ETF/No Load Fund Tracker—Monthly Review—June 30, 2012

The ETF/No Load Fund Tracker—Monthly Review—June 30, 2012

Month End Rally Lift US Stocks; European Union Inches Closer To “More” Union

US stocks rallied the last business day of June with the S&P 500 locking in 2.5 percent on the day to post its biggest single session gain since December after European leaders agreed on a series of short-term measures to ease the region’s ongoing debt crisis.

However, I have to caution you that not much real headway has been made, and any progress can only be counted once paymaster Germany clearly agrees to what has become much news headline propaganda.

EU politicians consented hope to form a single banking regulator to supervise the region’s banks and approved the use of the lifeboat funds to recapitalize stricken banks directly, a move aimed to lessen the debt burden of Spain and cap the spiraling borrowing costs of Madrid and Rome.

Markets got a further boost on the news that the European Investment Bank will receive €120 billion to be used for enhancing the bank’s lending capacity to businesses in an effort to create jobs. Where exactly the funds will be coming from has not been established, and the widely touted ESM mechanism has not been ratified by all countries (and is stuck in German courts for review).

US recovery remains questionable as economic indicators fluctuated for the month with some displaying downright bearish tendencies. As a result, the Federal Reserve revised the real GDP growth for 2012 downwards to range from 1.9 percent to 2.4 percent against the previously projected range of 2.4 percent to 2.9 percent. The unemployment rate was revised upwards and is expected to range between 8.0 and 8.2 percent from the previously forecasted 7.8 – 8.0 percent.

None of this so far has discouraged the markets from heading towards the highs made early in the year based on the faulty assumption that the Fed will always be there to bail out Wall Street. In my opinion, a major concerted stimulus effort by the various central banks is a distinct possibility, but ONLY after the markets have tanked, and 401ks have turned into 201ks, and not while the major indexes are flirting with the highs of the year.

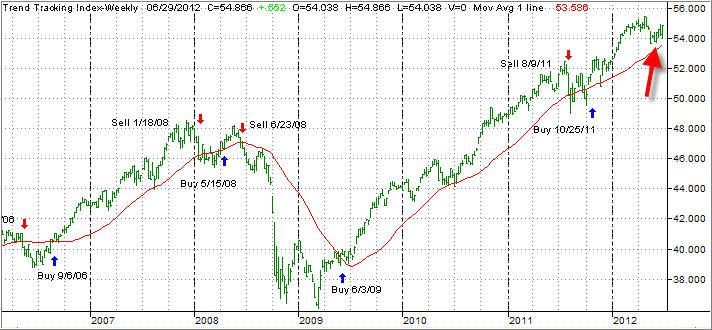

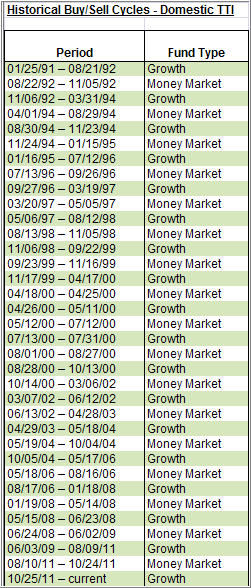

After our International Sell signal on 5/15/12, that arena has sank deeper into bear market territory but recovered somewhat towards the end of the month. Domestically, our Trend Tracking Index (TTI) remains on the bullish side of the trend line, as the chart below shows:

Market weakness early in the month (big red arrow) pulled this indicator within 1% of generating a ‘Sell,’ but continued hope about a resolution for the European debt crisis, kept support alive, and we remain in ‘Buy’ mode.

During the volatile times we got stopped out of the VTI position, but are still holding on to DVY, which has been a steady influence for those accounts exposed to it. The European debacle will end up badly, I am sure, but that does not make it an imminent event.

The timing is the great unknown, and I would have expected the end of the road to be reached much sooner than it appears. Nevertheless, my preferences in these uncertain times is to be predominantly exposed to those bond ETFs, which are the main stay of the ETF Model Portfolio #2 (BND, TIP, BSV).

My reasoning is that if the situation in Europe worsens, which it will, the flight to safety will be on and that will bode well for US bond related issues. Things can unravel in a hurry, as the global slowdown continues, and US equities will not decouple from the rest of the world as we are all tied at the hip—economically speaking.

Even for our bond positions, I have sell stops in place to be executed should unexpected market turmoil occur. It’s important to be prepared for all eventualities, as best as I can evaluate them.

Contact Ulli