US equities marched south Monday with all three indexes losing about one percent as markets remained concerned over the future of the currency-union in Europe and the safety of American banks following JP Morgan’s unexpected 2-billion trading loss.

Greece’s political parties struggled to form a coalition over the weekend, fuelling fears of a re-election that is expected to swing towards the extreme lefts who have vowed to reverse the country’s austerity measures, risking its continuation in the eurozone. Long-term, that would be the best solution for Greece.

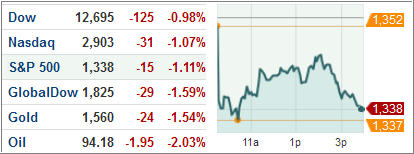

The Dow Jones Industrial Average (DJIA) tumbled 125.25 points while the S&P 500 Index (SPX) lost 19.64 points to settle at 1338.35 with the financial sector faring the worst among the 10 business groups.

The tech-heavy NASDAQ Composite Index (COMP) dropped 31.24 points to close at 2902.58.

Treasuries were the beneficiaries and advanced, pushing 10-year yields down to a seven-month low after German Chancellor Angela Merkel’s party suffered an electoral setback in the nation’s most populous states. Sentiment weakened further as the political deadlock in Greece continued, heading towards a re-election that will ensure the country’s exit from the EU.

ETFs in the news:

During most sell offs, the Barclays iPath S&P 500 VIX Short-Term Futures ETN (VXX) reigns supreme, as it did today, rising 5.5 percent. VXX tracks the so-called fear tracking VIX index, which gained about 10 percent to settle at a multi-week high of 21.77 as political turmoil in Europe continues to dominate headlines.

Among the day’s top losers, the iShares MSCI Brazil Small Cap Index Fund (EWZS) sank 4.35 percent as Brazil battles political disturbance and emerging markets showed weakness amid European turmoil. EWZS tracks the MSCI Brazil Small Cap Index, and hence is more volatile than blue-chips. Also profit booking by investors weighed on the fund’s performance today.

The US natural gas futures related products continue to retreat after Friday’s storage report. The United States Natural Gas Fund LP declined 3.35 percent while the United States 12 Month Natural Gas Fund (UNL) shed 2.42 percent for the day.

In regards to trends, things are getting weaker by the day. While our Domestic Trend Tracking Index (TTI) still resides on the bullish side of the trend line, it does so by only +2.92%. Right now, the International TTI has taken over the lead by crossing its trend line to the downside by -1.43% thereby generating a ‘Sell’ signal for all broadly diversified international funds/ETFs.

We have been nibbling on the bearish side for a few trading days, but today’s action constitutes a clear break to the downside. You should not be holding any funds/ETFs in that category.

Now, there is one exception. If you have just set up the conservative Model Portfolio #2, you will have exposure to VEU, the international component. You can, if you like, hold this ETF subject to its own respective 7% trailing sell stop in order to avoid a possible whipsaw signal.

Disclosure: No holdings

Contact Ulli