The ETF/No Load Fund Tracker—Monthly Review—April 30, 2012

The ETF/No Load Fund Tracker—Monthly Review—April 30, 2012

Major Market Indexes Pull Back Slightly

The broad markets closed lower in April for the first time in 2012, with only the Dow Jones Industrial Average gaining a negligible 0.01 percent for the month.

The S&P 500 Index ended 0.8 percent lower after four months of growth in a row while the tech-heavy NASDAQ Composite Index dropped 1.5 percent.

Economic data for the month remained mixed though corporate earnings by and large remained above the much lowered bar, with three-fourth of the S&P companies beating analysts’ expectations.

Weekly jobless claims stayed elevated for two consecutive weeks in a row at the end of April, suggesting the economy may be stagnating.

The first quarter GDP growth reading came in at a lousy 2.2 percent versus 3 percent in the final quarter of 2011. However, the Institute for Supply Management reading expanded unexpectedly in April, suggesting that manufacturing is on the recovery path.

US Commerce Department data showed consumer spending rose slower by 0.3 percent in March while personal income grew by 0.4 percent, improving the savings rate to 3.8 percent versus 3.7 percent in Feb. Consumer spending grew by 2.9 percent in the first quarter of 2012, marking the fastest growth in more than a year.

The Consumer Confidence Index for April slipped to 69.2 in April from 70.2 in the prior month. Inflation rose 0.2 percent in March, pushing the annual index down to 2.1 percent from 2.3 percent in February, if you can believe the official numbers. Nevertheless, this was in line with the Fed’s target of 2 percent annual inflation rate till 2014.

However, don’t be surprised if the Fed decides to inject further liquidity by undertaking another round of quantitative easing after the current measures end in June. That possibility will definitely come into play, should the markets take a dive to the downside.

US Treasuries continued to rise as safe-haven assets demand grew over an uneven economic recovery. Yield on the benchmark 10-year notes dropped below 2 percent, reflecting concerns over European and global economic environment. 30-year yield also dropped marginally, indicating the Federal Reserve is unlikely to raise record-low interest rates in near future.

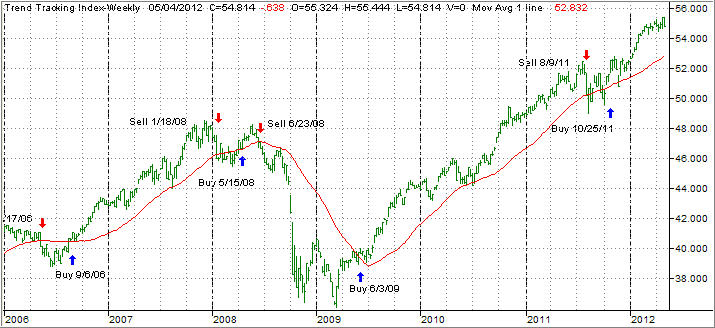

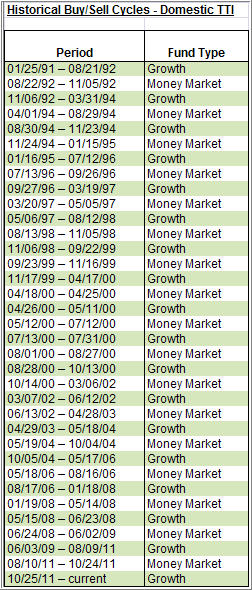

Our Domestic Trend Tracking Index (TTI) inched higher meaning that we’ve ventured deeper into bull market territory for the time being. Here’s the latest chart:

What has pushed the markets to these elevated levels YTD? It certainly has not come from the recent releases of economic data points. In my mind, the primary reason behind this upward momentum is the simple fact that the Fed has established a safety net via the various QE stimulus packages, such as we’ve seen over the past two years.

Wall Street bulls have been smoking “hopium” assuming that, should the markets head south sharply, the Fed will come to the rescue with another QE package and pull the indexes out of the doldrums. Despite the trillions of dollars spent, QE has done nothing to solve current economic woes, but it has supported stock prices. How long that can continue is anyone’s guess.

On the international front, Europe continues to rock the global recovery boat. The Dutch coalition government collapsed towards the end of the month following differences over further spending cuts.

The presidential elections in France added another dimension to the ongoing uncertainties as incumbent President Nicholas Sarkozy lost the first round to Socialist candidate Francois Hollande. There have been enough indications that Hollande is unlikely to continue with austerity measures and frustrate the present EU-wide effort of bringing more fiscal compliance in the eurozone. In other words, the eurozone agreement may very well unravel after the final elections on May 6th.

Adding to the uncertainty this weekend will be the Greek elections, which also can have dire consequences for those supporting the current eurozone circus.

Ratings agency Standard and Poor’s downgraded Spain after Madrid failed to stick to the 2012 budget-deficit target, raising fears that the Iberian nation may be the next country to seek a bailout. To me, it’s not a matter of if but when Spain will be looking for international assistance.

Since we are on the bullish side of the trend line (see chart above), I am predominantly sticking to my ETF Model portfolios #2 and #4, as they offer a good balance of equity vs. bond holdings during these uncertain times where a sudden unexpected event could derail global markets.

For added safety, I have set up my trailing sell stops for all holdings, which will get us out of the markets quickly and effectively, should the need arise.

Contact Ulli