US stocks ended mixed Thursday with the broad market ETFs retreating for the third successive day in a shortened week, as worries over Spanish debt crisis returned to haunt Wall Street.

All the indices closed lower for the week despite better weekly claims data ahead of Friday’s nonfarm payrolls reading for March. As equities sank, US Treasuries marched ahead for the second day in a row as rumors over worsening Eurozone debt crisis triggered demand for safe-haven US debts.

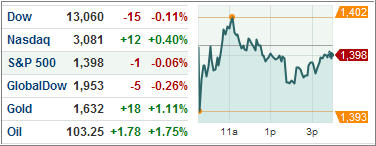

As demand for French debts wilted prices of ten-year US Treasuries jumped to their highest two-day level since January. The Dow Jones Industrial Average (DJIA) slipped 0.1 percent to 13,060.1, down 1.2 percent over last Friday.

The S&P 500 Index (SPX) shed less than 0.1 percent today but dropped 0.7 percent for the week, with the defensive sectors giving back the most and consumer-discretionary sector faring the best among its 10 major industry groups.

The NASDAQ Composite Index (COMP) bucked the day’s trend and added 0.4 percent to close at 3080.50, still off 0.4 percent over last Friday.

Benchmark 10-year yields on Treasuries dropped five basis points to 2.17 percent, despite economists predicting that the US economy added more than 200,000 jobs in March ahead of the official data tomorrow.

ETFs in the news:

The fear-tracking iPath S&P 500 VIX Short Term Futures ETN (VXX) is seeing good days, as the European debt crisis continues to spook the market. It added 2.16 percent for the day, its second four-day home run in 2012 after the Federal Reserve quashed hopes of further monetary stimulus in the near future.

As Europe continues to sink, Asia-related funds staged a comeback with the Guggenheim China Small Cap ETF (HAO) adding 2.51 percent on the day. Most Asia related products including the Market Vectors Indonesia ETF (IDX), the iShares MSCI South Korea Index Fund (EWY) and the Market Vectors Vietnam ETF (VNM) ended in green.

After two-days of battering, precious metals managed to stage a comeback with the ETFS Physical Silver Shares (SIVR) jumping 1.45 percent. The yellow metal tracking SPDR Gold Trust (GLD) also rose by 0.7 percent Thursday.

Among the day’s losers, the iShares MSCI Austria Investable Market Index Fund (EWO) sank 2.72 percent as Europe starts to look vulnerable again. The iShares MSCI Spain Index Fund (EWP) also retreated for the day.

As the energy industry continues to store natural gas at a faster rate than Americans can consume it, the United States Natural Gas Fund (UNG) slipped by more than 2 percent in today’s trading.

I will send out Friday’s ETF Tracker as usual accompanied by a short commentary about the jobs report. The updated weekly StatSheet will be posted later on tonight.

Disclosure: Holdings in GLD

Contact Ulli