US stocks slipped Tuesday with the Dow Industrials declining for the first time in four days after the minutes from the Federal Reserve Open Market Committee indicated lesser possibility for further monetary stimulus. The markets reminded me of that famous Rolling Stone song “you can’t always get what you want,” as another QE had been expected.

Treasuries sank, pushing 10-year yields to their highest level in more than a week as speculators closed positions after the Fed indicated halting further quantitative easing.

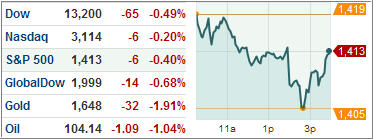

The Dow Jones Industrial Average (DJIA) retreated 0.5 percent to end the day at 13,199.50. Markets witnessed a sell off after speculations over another round of monetary stimulus turned out not to be on the front burner with the Fed. However, last hour buying limited the downside move, as we have seen just about during all recent sell off attempts.

Automobile sales remained in focus today as sales in March were robust for carmakers. The S&P 500 Index (SPX) declined 0.4 percent to 1413.16 with utilities in the 10-sector index shedding least while energies lost the most. The NASDAQ Composite (COMP) shed 0.2 percent to end at 3113.57 despite Apple hitting an all time high.

Treasuries eased previous gains after minutes of Federal FOMC showed policy makers are likely to hold back further stimulus unless the economy stumbles. Benchmark ten-year yield climbed 0.10 percent to 2.29 percent, while yields on 30-year Treasury bonds rose eight basis points to 3.42 percent.

ETFs in the news:

Volatility index tracking iPath S&P 500 VIX Short Term Futures ETN (VXX) jumped 0.74 percent for the day, as US markets reversed previous four session’s gains. While VXX had a mixed fortune, the VIX index actually witnessed four days of positive action.

The iShares MSCI South Korea Index Fund (EWY) added 0.7 percent on the day, touching new 2012 highs after three days of consecutive progress.

The iPath Dow Jones UBS Natural Gas Subindex Total Return ETN (GAZ) topped the day’s losers list, shedding 4.49 percent over Monday, while another gas ETF, the United States Natural Gas Fund (UNG), rose 1 percent. GAZ’s decline can be attributed to more than 85 percent premium.

Miners across the board were hit today with the Market Vectors Junior Gold Miners ETF (GDXJ) dropping the most among miners. GDXJ lost 3.25 percent as equities witnessed choppy trading Tuesday.

An extended downturn ensured Market Vectors Solar Energy ETF (KWT) gave back its entire gains in 2012. KWT shed 4.34 percent today and is trading near its December 2011 levels.

The iShares MSCI Spain Index Fund (EWP) dropped 3.67 percent after latest data showed unemployment in Europe has hit a 15-year high. Europe remains risky as Italy would need to refinance €750 billion in debts over the next three years. Spain would need to roll-over debts worth €370 billion during the same period.

If you are a conservative investor, you should not have any exposure in these regions, unless you have a clear exit strategy in mind. In my view, Europe remains a powder keg that can blow up any time since none of the underlying structural problems (too much debt wherever you look) have been addressed.

Disclosure: Holdings in EWY

Contact Ulli