The ETF/No Load Fund Tracker—Monthly Review—March 31, 2012

The ETF/No Load Fund Tracker—Monthly Review—March 31, 2012

Markets Remain In Rally Mode

US stocks managed decent gains in March that pushed the large-cap indices back to multi-year highs seen earlier in the month.

The majority of the gains were achieved in the last week of the month when Federal Reserve chairman Ben Bernanke said prolonged weakness in the labor market due to a general shortfall of aggregate demand merited an accommodative monetary policy, a term that was interpreted as an indication of further rounds of quantitative easing, if required.

The monthly job data remained robust and weekly jobless claims in the last week of the month dropped to a level not seen since April 2008. Consumer spending increased at a faster pace though personal income gains were modest, validating Bernanke’s observation of structural weaknesses in the labor market. The University of Michigan consumer sentiment index also hit its highest level.

All was not well on the western front, however, and some weaknesses restricted the stock market rally. A report showed pending home sales dropped in Feb, factory activities slowed down in the Midwest, and durable goods orders did not bounce back as forecast. The final reading of fourth quarter GDP however, came as a breather, showing the economy expanded at 3 percent, as had been widely anticipated.

Large caps generally outperformed the markets due to the predominance of tech companies in the large cap growth companies, and the technology sector has been one of the best performing sectors thus far this year. Also, sectors that performed poorly in 2011, technology, consumer discretionary and financials, have performed very well while defensive sectors such as utilities and consumer staples that led last year have lagged in 2012.

There are risks, however, with European credit crisis spreading to other countries and China slowing down in the coming months. The ECB has been trying to live up to the challenges by providing about a trillion Euro band aid via cheap loans for three years to the region’s banks to avoid a credit crunch witnessed following Lehman Brothers collapse.

Also European finance ministers approved a combined rescue fund of about €720 billion when they met in Copenhagen in the last week of March. That should at least temporarily soothe nerves of those who have been fretting over Spain and Italy drowning the EU region and give some time to get their houses in order. Central banks of Brazil, China and India have either begun to lower official interest rates or have lowered bank reserve requirement rates, releasing money into the system.

Domestically, the housing and employment data have been better compared to what we saw in 2010 and 2011, although much of it has been simply a byproduct of rapid Fed stimulation designed to keep the markets aloft.

What we’ve seen in the market during this first quarter has almost been a carbon copy of the up moves from 2010 and 2011. In case you forgot, the major averages tanked big time during mid-year and were “rescued” each time by another round of Fed easing (QE1 and QE2).

That’s a clear sign to me that the economy and the markets are artificially propped up and sooner or later a sense of realty will pull us off these lofty levels, which may very well result in the next round of stimulus being applied.

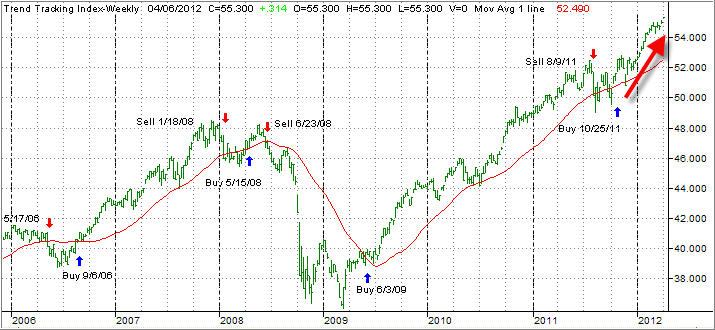

However, right now, the markets are heading north, as demonstrated by my Domestic Trend Tracking Index (TTI):

It is obvious that this trajectory is simply not sustainable and some form of a pullback is a given; the timing of it is the unknown. This is why, despite the euphoria on Wall Street, I am committed to our exit strategy for all of our portfolios based on our trailing sell stops.

Based on blog reader feedback I have received, there is great complacency among market participants based on the hope that the Fed will be able to put a floor under any correction. I certainly would not count on it, as continued stimulus efforts will eventually lose their effectiveness.

Contact Ulli