The ETF/No Load Fund Tracker—Monthly Review—January 31, 2011

The ETF/No Load Fund Tracker—Monthly Review—January 31, 2011

A Hot January For Equity ETFs

While 2011 didn’t offer much hope for investors, 2012 got off to an unexpectedly great start with U.S. major market ETFs leading the way, gaining significant traction to move further into bull territory. The S&P 500 gained over 4% for the month to have its best January since 1997 while other indices also performed well.

Nevertheless, the main focus is on developments in Europe, especially as they pertain to Greece.

Negotiations between Greek leaders and bondholders leaders seem to have no end, putting its March bailout payment in jeopardy. By the end of January, a 70 percent haircut was considered although bondholders are pushing for new 30-year bonds with a favorable interest rate, causing further consternation. With the IMF and others also throwing their two cents in on conditions of the potential deal, it’s a messy stew with too many chefs.

Not only is Greece feeling the heat, but Portugal is heading down a dark road. With bond yields tipping over 17% and a debt-to-GDP ratio approaching 120%, Portugal might soon find itself in Greek shoes.

If Portugal can’t restore investor confidence and successfully implement austerity measures, it will have to restructure its debt, causing further strain on Europe’s already limited funding capacity. Although the Eurozone can arguably bail out Greece and Portugal, this is simply out of the question for Spain and Italy, whose combined debt nears $4 trillion.

Although Europe is falling apart, solid upward momentum, especially during the first few trading days of 2012, has prompted me to add some additional equity/sector ETF exposure in addition to bond ETFs. This brings us to an invested level of roughly 90%, depending on portfolio size.

Given Europe’s continued lack of progress in solving the debt crisis, my goal is mimic our ETF Model Portfolio #2 since it is more conservative with a 40% holding in bond ETFs. Treasury Inflation Protected Securities (TIPS) are particularly attractive since they outperformed the S&P 500 during a sluggish 2011. With holdings in Vanguard Total Bond Market ETF (BND) and Vanguard Short-Term Bond ETF (BSV), we have positioned ourselves to absorb any potential negative shocks to our equity ETF allocation possibly due to European uncertainty.

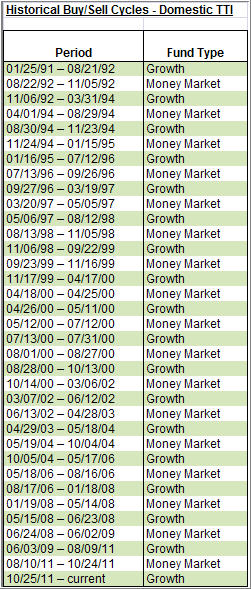

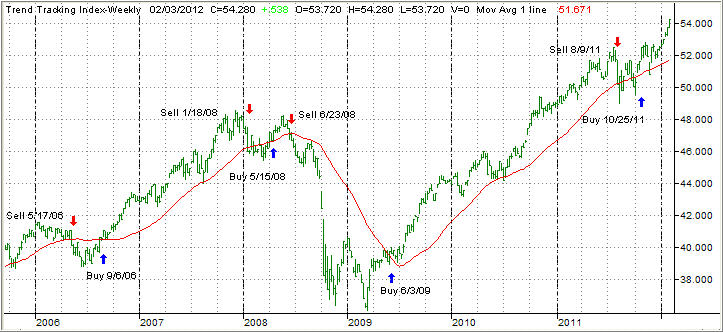

As far as our equity exposure is concerned, we have added some new equity ETF names to take advantage of the upside. Our Domestic TTI remained in bull territory over 4% as the chart below shows:

For instance, we have replaced Vanguard Total Stock Market ETF (VTI) with iShares Dow Jones Select Dividend (DVY), which yields 3.44% and has held up better during market corrections. Some REIT exposure via Vanguard REIT Index ETF (VNQ) has been a good choice for us, as there have been some solid positive jumps. Also, one of our mainstay holdings, Consumer Staples Select Sector SPDR (XLP), has been on an upswing.

Despite positive trends stateside, the international sphere isn’t as inviting for equity exposure. Although the International TTI is now barely in the green, I am hesitant to add international ETF exposure until I see a prolonged upward shift. The International TTI’s position relative to its long-term trend line greatly improved over the course of January, but my current preference is to add a country ETF, a small gold position, or possibly both. While gold took a dive during the second half of 2011, it has rebounded nicely as the uncertainties in Europe have not disappeared.

All in all, Europe remains front and center as the situation appears to be worsening by the day. Futile attempts by incompetent politicians to offer endless band aid approaches are causing me to remain conservative in my investment stance. That includes having my trailing sell stops ready to be executed should the markets dictate that it is in our best interest to do so.

Contact Ulli

Comments 1

I am a newbie here. For an unexplainable reason, I have always been late on the buy and sell signals (my fault, finger freezes when I have to click the button). So, I truly appreciate your CONSTANT reminder to have our sell stops in place. Your remindings are often (a good thing) and invaluable! Please, keep reminding us…