This is the last ETF Model Portfolio report for 2011. I will rebalance as necessary effective 12/30/11 and will determine the exact allocation next weekend.

While the past week sported an upswing in the markets, it barely got the S&P 500 to the breakeven point for the ear. In the end, 2011 did nothing to help your portfolios grow as continued global uncertainties unleashed a wildly swinging market, which ended up returning to the unchanged line.

Our sell stops were only of limited value, as a sharp correction did not occur even though it appeared to be a distinct possibility on several occasions. Of course, Europe’s expert can kickers managed to avoid disaster by coming up with more ingenious ways to delay the inevitable.

Even though I will rebalance the ETF Model Portfolios, I do not recommend starting the year 2012 with fully invested positions as none of what ails Europe has been resolved and may come back to haunt the markets.

On the other hand, the major indexes may hang their hat on the fact that domestically we’re better off right now than the rest of the world with the result that upward momentum may continue. Personally, I believe it’s a better call to only conservatively participate in any upward swings as the ongoing downside risks should not be underestimated.

Take a look at the latest update:

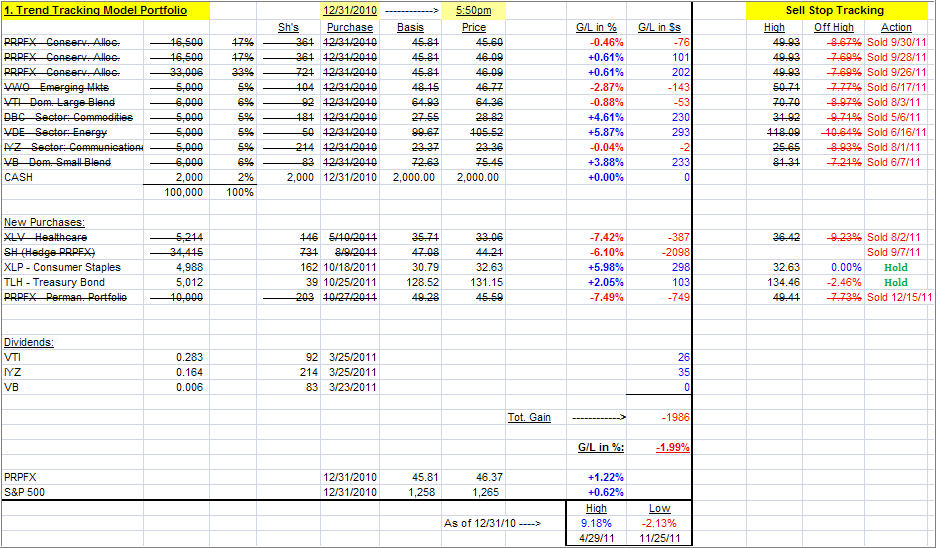

1. ETF Trend Tracking Model Portfolio

[Click on any table to enlarge]This is the portfolio allocation I have used predominantly use in my advisor practice during the early part of 2011. Given current market conditions, and an ever growing number of global hotspots, I like the concept of having a solid core holding in PRPFX, although we got stopped out as a result of the recent wild market swings.

Around this fund, when in buy mode, I add what I call boost components consisting of ETFs that can produce higher returns than my core holding, at least during bullish periods. When a market pullback occurs, the core holding should add an element of stability.

Nevertheless, as you know from my writings, anything I invest in involves the use of trailing sell stops, which are shown and tracked on the upper right of the table.

Last week, this portfolio was down YTD -2.03% vs. -1.99% as of today.

Why is this portfolio negative YTD? Since the markets did not follow through to the downside on 8/9/11, adding the short position and creating a hedge reduced our realized gains by some 2%. This is the cost we pay at times for downside protection.

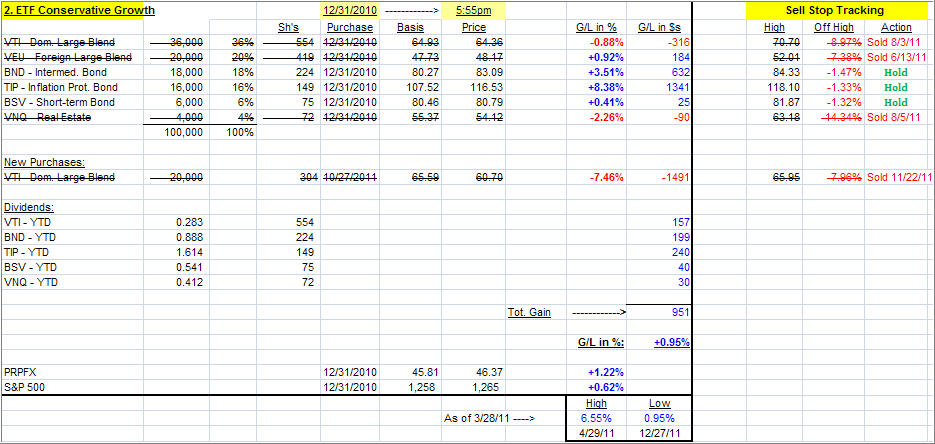

2. Conservative ETF Growth Portfolio

This portfolio, as are the following ones, would be typical of what is being used in the buy-and-hold community, as you can see by the 40% allocation to various bond ETFs. If you are conservative, this simple combination could work for you, but I still recommend the use of the trailing sell stops during these uncertain times.

Last week, this portfolio was up YTD +1.31% vs. +0.95% as of today.

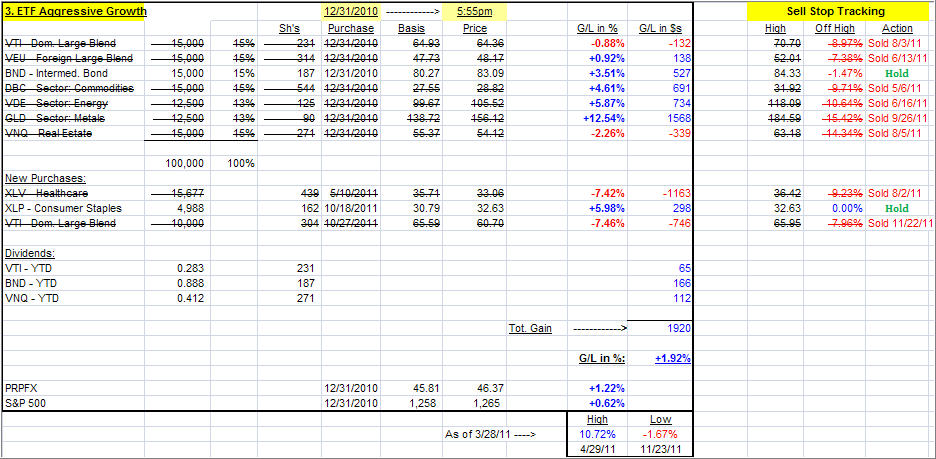

3. Aggressive ETF Growth Portfolio

What makes this one aggressive is the small 15% allocation to bonds. If you have an aggressive streak in your personality, you could consider this one. If you use my recommended sell stop discipline, you know exactly ahead of time what your downside risk will be.

Last week, this portfolio was up YTD +1.96% vs. +1.92% as of today.

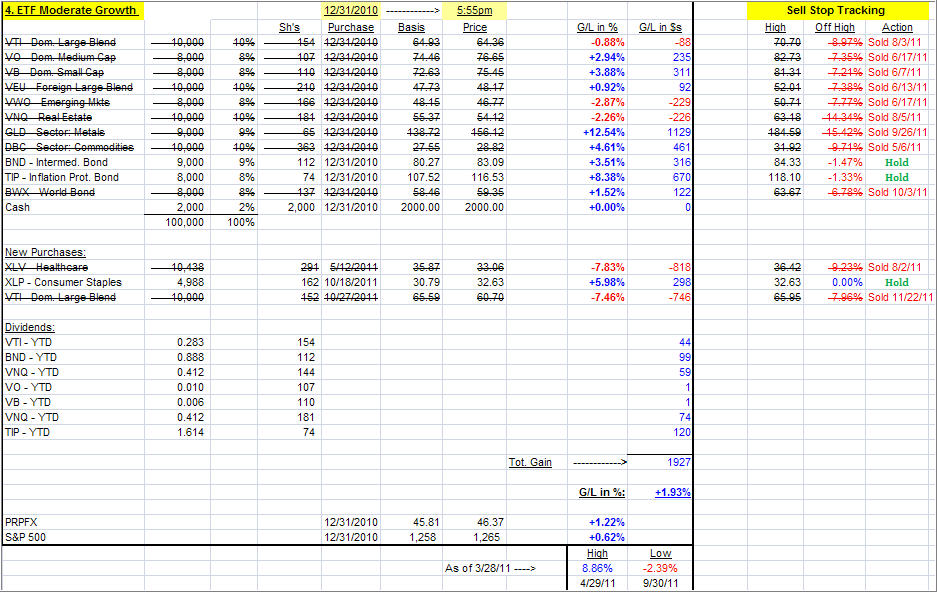

4. Moderate ETF Growth Portfolio

I call this one moderate growth, because of the higher allocation to various bond ETFs (26%) than in the aggressive set up above. It is also more diversfied domestically.

Last week, this portfolio was up YTD +1.98% vs. +1.93% as of today.

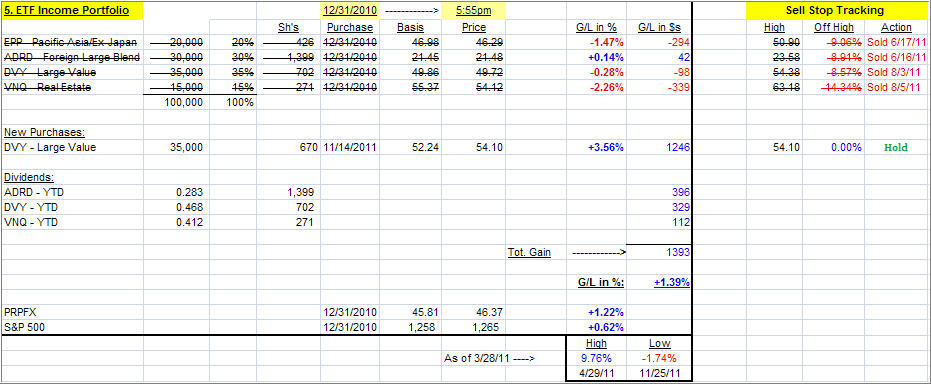

5. ETF Income Portfolio

This is as simple as it gets, but during the recent sell-off, it dropped in value quickly due to no offsetting bond positions and showed a 0% invested balance by August 2011.

Last week, this portfolio was up YTD +0.75% vs. +1.39% as of today, as the new position in DVY has turned out to be a winner in the current market environment.

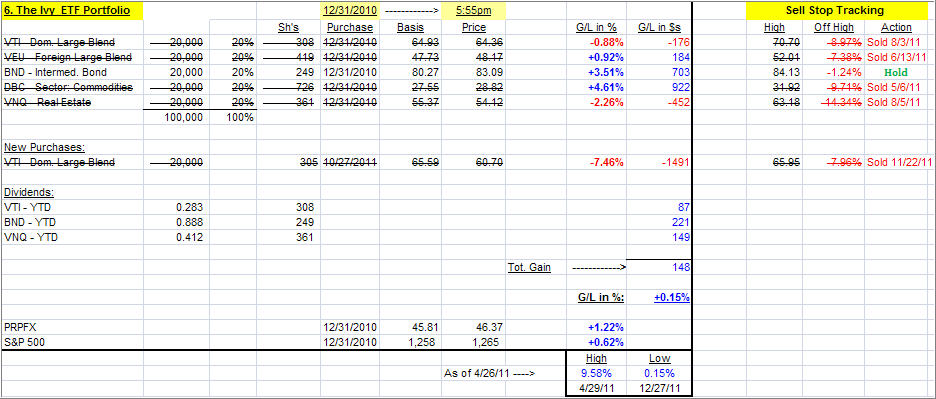

6. The Ivy ETF Portfolio

If you missed the recent post about the Ivy portfolio, you can read it here.

This is a simple 5-asset class portfolio with each individual component being bought when it crosses its respective trendline to the upside. Each component is being sold once it crosses its trend lines to the downside again, according to the author’s rules.

I have made 3 adjustments:

1. I apply a 39-week Simple Moving Average (SMA) to generate the Buys, while the authors use a 45-week SMA.

2. As mentioned in the blog post, I prefer using my trailing sell stop discipline for my exit strategy.

3. Personally. I favor using BND (as opposed to IEF) as my bond component, since it has shown more stabilty in the past.

Last week, the Ivy portfolio was up YTD +0.34% vs. +0.15% as of today.

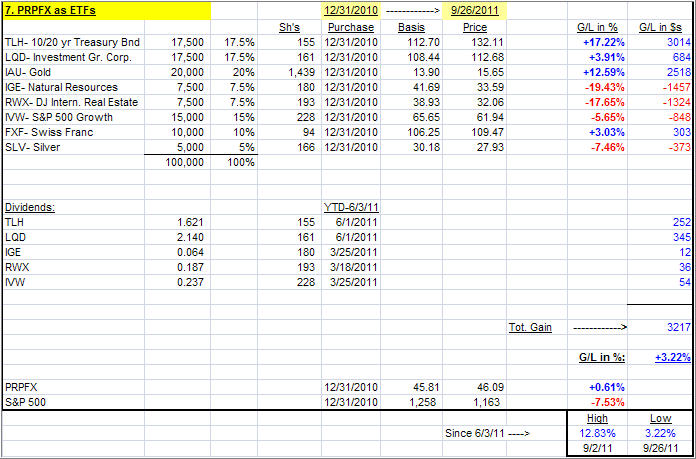

7. The ETF Equivalent of PRPFX

As posted recently, I have created and backtested the ETF equivalent, which clients of mine own as well, of my favorite mutual fund, PRPFX, which is a core holding in my #1 Portfolio. If you missed it, you can read the announcement here.

Take a look at the combination of ETFs:

In the current market environment, where just about all equity indexes have lost, this portfolio has bucked the trend and produced a remarkable result. While this is only one moment in time, and there are no guarantees that this will continue, we need to work here too with a trailing sell stop discipline to guard against excessive downside risk.

Since these 8 ETFs represent only one fund, namely PRPFX, we need to apply a different exit stratgey. For that purpose, I will not track the high points made for each ETF, as with the other 6 models, but measure my drop from the high point this entire portfolio has made. As a result, with last week’s slide in the metals, we got stopped out effective 9/26/11. The gain was +3.22%.

A new entry point, to reestablish the positions, will be once PRPFX climbs clearly back above its long-term trend line.

(ETF trading costs are not included in these portfolios demonstrations. They are intended to show market effects on differend scenarious only as an educational tool)

To repeat, the key to selecting a portfolio from the above list is not just performance. Personally, I’d rather lag a little on the upside but have some assurance that I will also lag when the downside comes into play.

I will update these portfolios every Wednesday.

Quick Reference:

Contact Ulli

Comments 9

Question:

Why have you stopped the #7 Portfolio as of 9/26/11 ?

Maghar,

We got stopped out of that portfolio and have not reentered due to PRPFX having remained below its long-term trend line.

Ulli…

Hi Ulli,

New subscriber. Stumbled upon your site/newsletter while researching for advice on investing in these troubled times we are in. Have been basically a buy&hold investor to date but took a bath in 12 and 08, and want to not go through that again by using your Stop/Sell approach.

Current 40% in cash and the balance in very modestly performing (vs S&P) mutual funds. I like your approach and would like to begin following it, however for a new investor using your methodology I have some newbie questions:

1. Your current 6 active portfolios have mostly Sell designations with no Buys and only 6 ETFs (all portfolios) designated as Hold. So I guess I could follow your 1/3 and 5% rule and start to buy the Hold ETFS as your general advice is to be in bond/sector ETFs, or cash at this time. I can tolerate a moderately high degree of risk so am not bound by one precise risk level portfolio.

2. Another approach is to go with one, or more, portfolios and buy the Holds on the same basis as (1) above. But restrict the percentage of money invested to the ratio of new investments to total in the portfolio.

2. How much cash? Do you have a percentage (of the whole portfolio) to recommend right now.

Hope this makes sense to you.

Any other thoughts, advice, recommendations will be gratefully received, and many thanks for your advice, and the eBooks you provide at no charge.

Robert,

The cash allocation and/or invested percentage depends strictly on your risk tolerance. There is no canned number that I can recommend. There is tremendous uncertainty in the markets, and my preference is to play it more conservatively.

Ulli…

Ulli,

Weitz recently downgraded FDRXX where I have a very large percentage of my money. Fidelity claims to not be exposed to European dangers.

What do you think of GNMA funds or the safety of Money Market Funds such as FDRXX?

Thank you for your very helpful commentaries, and I wish you a very Healthy, Happy, and Prosperous New Year!

Bob

Bob,

I don’t use Fidelity at all, so I am not qualified to comment on their money market funds. I can state in general that many of the big brokerage firms have severely limited their exposure to those European holdings that have historically been a cornerstone of money market investments. In terms of GNMA funds, please send me a ticker symbol of the one you have in mind. Personally, I don’t invest in GNMA or FNMA obligations as I believe they are all insolvent and only being propped up via government support.

Happy New Year to you as well.

Ulli…

Ulli,

Thanks for providing this great service. I think the portfolio spreadsheets would be clearer if they include current holdings with dollar amounts for each and a total dollar amount for the portfolio. If on 31-December-2010, the portfolio had an initial $100,000.00 balance and on 31-December-2011, the total is $105,216.12, you can quickly see how the portfolio is performing.

Thank you

Did I miss the re-balance 7 portfolios you predicted would be available this weekend (effective 12/30/11).

Happy (investing) New Year to you and yours

Robert,

As always, the updated model portfolios will be published every Wednesday morning.

Ulli…