The ETF/No Load Fund Tracker—Monthly Review—December 30, 2011

The ETF/No Load Fund Tracker—Monthly Review—December 30, 2011

ETFs Don’t Know Where To Turn

As the holiday season approached, markets were relatively inactive in the last week or so. The S&P 500 gained 0.85% in December although ending flat for the year. However, there wasn’t clear direction in market movements as broad indices swung up and down with no real discernible pattern. The S&P 500 is above its 50-day Moving Average, but that can quickly change.

The underlying current determining investor sentiment continues to be Europe. The Euro dropped to an 11-month low against the dollar, hitting $1.29/Euro at one point. Also, the month of December witnessed a litany of ratings downgrade warnings due to deteriorating finances and burgeoning debt loads. Leading the pack are Italy and Spain, which still not only have higher borrowing costs approaching 7%, but can’t seem to impose enough austerity to balance their budgets, further hurting their economic prospects.

In a drawn out tragedy, Greece still can’t come to compromise with creditors over the extent of the bond haircut or agree to additional bailout conditions, putting its Eurozone survival in great jeopardy. We should err on the safe side and place a high probability on a Greek exit that could rattle markets. Thus, we have positioned ourselves by keeping a low risk portfolio.

Nevertheless, we are sticking to selective buys on equity/sector ETFs with the exception of international equity ETFs and bear market funds. With the International TTI (Trend Tracking Index) finishing December at -7.65%, the international investment space is fraught with significant volatility. In this uncertain environment, we are keeping a majority bond ETF position and cash.

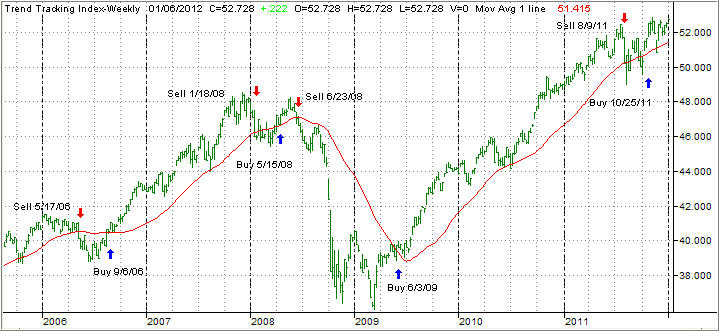

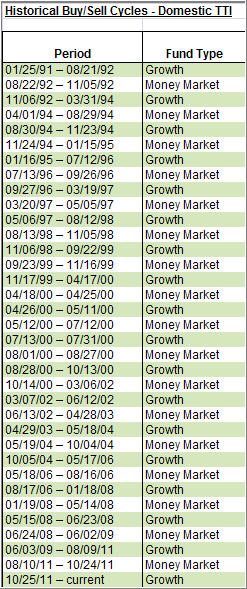

On home turf, the Domestic TTI finished the month above its long-term trend line at +2.33% as the chart below shows:

Thus, we still want to retain some minimal equity ETF exposure. Our go-to ETF for this has been Consumer Staples Select SPDR (XLP), which isn’t as susceptible to overall market volatility.

With all eyes on Europe, the uphill battle hasn’t gone away. Although the ECB instituted 3-year LTROs (Long Term Refinancing Options) to inject liquidity into a borderline insolvent banking system, this is merely a short-term solution. European banks are still hesitant to lend as they worry about counterparties fulfilling their loan obligations. In the end, the real economy has to bear the cost as funds meant to spur the economy aren’t channeled out.

Looking at the big picture, talks of a reformed EU treaty have further strained inter-European relations. Disagreements over deficit reduction conditions as well as how much autonomy countries can have over their own financial affairs has caused a rift questioning whether the Eurozone can maintain unity.

Asia’s economic condition is also deteriorating. China must come to the realization that it can’t grow its economy solely on the back of exports. Meanwhile, Japan’s strong Yen has made economic expansion via exports difficult while its domestic demand has been anemic.

In the U.S., December wasn’t a groundbreaking month other than wondering if the Fed will go ahead and enact QE3. Otherwise, investors kept flocking to Treasuries/bonds as global uncertainty remains elevated. The U.S. economic situation hasn’t truly improved, but the bleak overseas picture is enough for investors to seek refuge in U.S. government securities.

While markets slightly edged up in December, I don’t envision a breakout to the upside any time soon. Overall economic fundamentals suggest that we’re in for a long-haul with bulls and bears engaged in a continued tug-of-war.

As 2012 has kicked off, my advice is to continue adhering to a bond ETF tilted portfolio with strict stop loss protection in the event of a major market slide.

Contact Ulli