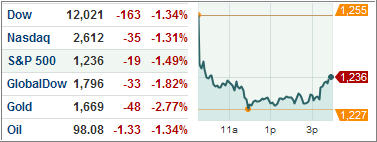

Despite an EU Summit that appeared to hint towards fiscal unity and discipline, markets didn’t quite agree with that sentiment today. The S&P 500 slid 1.49% while European markets also had a rough day. With cracks still showing in Europe’s financial system, the Euro took a dip against the dollar down to $1.32/Euro.

Unlike most down days though, volatility actually slightly subsided with the VIX falling 2.69%.

However, investors sought out government securities as the 10-year Treasury dropped 2.10% to yield 2.01%. Meanwhile, gold and oil fell 2.85% and 1.54%, respectively.

Moody’s announced that it will conduct a review of Eurozone sovereign credit ratings in the wake of the summit. In essence, last week’s summit failed to inspire much confidence. Anyways, I’ve seen little evidence that Europe currently has the tools to get out of its debt crisis unscathed.

Although there has been talk of the ECB reducing its intervention in bond markets, it had to do just that as Italy’s and Spain’s bond yields began rising once again. In the case of Italy, there are concerns over whether austerity measures will push through as Italian politicians couldn’t decide on the mix between spending decreases and tax increases.

In Greece, politicians seem to lack the muscle to reduce its spiraling debt load. The country has agreed to spending cuts but no rise in taxes while hitting roadblocks in reaching terms to get its second bailout package. For the sake of Europe, Greece needs to extricate itself and accept default in my opinion.

Meanwhile, talk is circulating that Commerzbank, Germany’s second largest bank, will need a bailout. If the relatively responsible Germany is showing signs of frailty in its banking system, this certainly doesn’t bode well for the rest of Europe.

In addition, the ECB’s interest rate cutting actions are making the Euro increasingly less attractive, as already witnessed by large Euro outflows in the last week. This might help export driven industries in Europe, but it’s no good for restoring confidence in a battered system where eradicating contagion is becoming increasingly difficult.

There’s also still little indication that a sustainable solution has been implemented. After failing to spot problems leading up to the financial crisis, the ratings agencies aren’t taking any chances this time around in evaluating Europe’s woes, which could have negative repercussions if downgrades occur.

I still believe we’re in a highly risky scenario and advocate a strong fixed income ETF tilt. In regards to bond ETFs and equity ETFs, while equity ETFs have moments of superior performance, bond ETFs have been the way to go in the medium-term to long-term in this volatile environment.

Contact Ulli

Comments 2

Thank you,Ulli for your wise and consistent overview. Especially valuable is the added dynamic of your insights into the European financial markets. Been a quiet follower of yours for years. Best of the holidays to you.

Thanks Shane; best Holiday wishes to you as well.

Ulli…