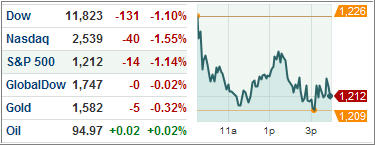

Major market ETFs continued to see red again as the situation in Europe worsens. Markets worldwide felt the brunt of the Eurozone’s woes as the S&P 500 fell 1.14% while some European indices hurt even more. In line with this, the Euro prolonged its slide against the dollar, now reaching $1.30/Euro.

There was some serious action in commodities as well. Gold dropped a massive 5.12% to hit $1,575 while oil took a steep drop down to $95. Also, 10-year Treasury yields dropped to a yield of 1.90% as investors flock to seemingly safer U.S. government fixed income securities.

Bernanke announced today that there are no plans for the Fed to offer direct aid to Europe. However, a major turn for the worse could change that seeing that the recent central bank intervention wasn’t initially planned. Europe is simply too volatile to have any concrete idea of what may come next.

Today was another extension of troubling signs persisting in Europe. Italy’s auction for 5-year bonds resulted in the highest yield in 14 years, indicating that investor sentiment has failed to improve. Plus, the 10-year bond crossed above the unsustainable 7% level again, making matters worse. The country faces further upheaval as it tries to push through austerity measures that are at odds with unions.

Greece is also proving to be a major laggard in getting its fiscal house in order. The IMF has put the heat on Greece for failing to implement austerity reforms in a timely manner. As I’ve suggested before, Greece is nothing more than a drag on the Eurozone and needs to seek out an orderly exit before the region descends into financial chaos.

The wave of downgrades ceases to break as Fitch issued downgrades for five European banks. It’s safe to say we can see more coming along the way from all agencies, as they have forewarned.

And with the increasing risk exposure seen in European banks, we are starting to see an increased flight to safety. Federal Reserve data indicates that in the last 6 months, deposits at foreign owned banks in the U.S. have fallen 25%. That money is now finding its way in U.S. based banks. The U.S. may not be immune to Europe’s issues, but for international investors, this country is still seen as a relatively safer option.

With three negative days in a row, not only is the international outlook dire, but our Domestic TTI (Trend Tracking Index) is inching closer to a potential sell signal. As of today, however, this index is still hovering +1.21% above its long-term trend line and therefore in bullish territory.

In light of this, the key is to maintain a strict sell stop discipline, so you don’t lose your shirt should downward momentum accelerate.

Contact Ulli

Comments 2

Ulli,

I am wondering what percentage you recommend for your bond holdings. I have stayed in cash because I read so many warnings about bond funds over the past year, but I’m now considering them since this mess in Europe appears to be never ending.

Debbie Baker

Debbie,

I have no general recommendation as this decision depends on your risk tolerance and other factors that I don’t know about you. I can provide you with the data to make a better selection but the final decision has to be yours.

Ulli…