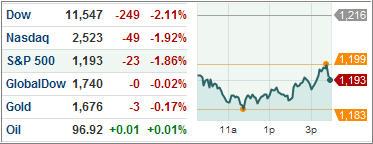

The week started off rocky as European fears set in, pulling the S&P 500 down 1.86%. Europe indices took an even harder hit with the DAX down 3.35% and the CAC 40 dipping 3.41%. In government bonds, the 10-year Treasury fell 2.49% to 1.96 as investors sought safety. Nevertheless, the dollar was unchanged versus the Euro, staying at $1.35/Euro.

Despite weakness in equities, gold had a rough day as well, falling 2.39% to drop below 1,700. Although the VIX only rose 2.84% today, there is a lot of risk still on the table. An indication of overseas tension, foreign banks have more than doubled their deposits at the Federal Reserve from $350 billion to $710 billion since late last year. While the U.S. has its fair share of troubles, it’s proving to be a relatively safe haven compared to Europe or Asia.

Following European ineptitude, the U.S. Super”dud”committee failed to agree on a deal to reduce the budget deficit. As if there wasn’t enough global political turmoil, Congress has added insult to injury. Looks like markets are going to be quite uneasy over the next few days.

In a domino effect of toppled governments, Spain has become the next victim as the country elected its new Prime Minister, Mariano Rajoy. Perhaps Rajoy will lead the country on a more sustainable path, but it will be approximately one month until the full transition to Rajoy, precious time lost as markets refuse to calm. Spain is in desperate need of a fresh start, but will that be enough to save it?

However, like Italy, Spain suffers stagnant growth and mounting debt. Even worse, it has incredibly high unemployment (roughly 50% of individuals under 25 are unemployed). As Spanish bond yields continue to approach the 7% level, Spain is hitting a major financial road block. On one hand, it needs to implement austerity measures to reduce its debt load. At the same time, Spain needs to spend in order to boost its economy.

Higher borrowing costs continue to spread throughout Europe as relatively stable France experienced a noticeable increase in bond yields, giving ratings agencies more justification to hand them a much talked about ratings downgrade. As options run out, the idea of the Eurozone issuing standardized Euro Bonds in lieu of countries issuing their own bonds has been thrown around.

I’ve been cautious about Europe the last several weeks because of contagion fears, which are coming to fruition for now. European and American political friction continue to get out of hand, and I believe that sticking to mostly bond ETFs and cash is the most sensible option until uncertainty subsides.

Contact Ulli

Comments 2

Ulli,

I’m puzzled about your continued interest in bond ETFs. Since the most likely response to the European AND American debt crisis is a rise in interest rates (already happening in Europe and very likely here soon despite possible intervention by the Fed). bond ETFs would seem to be pretty risky investments — even though they have done fairly well in the short term.

Lew,

Sure, you are right long-term. However, right now bonds are on the bullish side of the trend line, which is why I have some exposure in them. Once they trigger their 5% trailing sell stop points, I will liquidate my positions. That way I don’t have to guess as to the direction of future interest rates.

Ulli…