Markets continued to ride yesterday’s reversal, as major index ETFs and commodities such as gold and oil posted sizeable gains (S&P 500 up 1.79%, oil up 5.35%) while volatility subsided (VIX down over 7.5%).

However, this short-term market upswing appears to have little credence in the midst of a serious European debt crisis where there is a probable near term negative shock to the stock market as a Greek default becomes more likely.

Meanwhile, it has been suggested that a $2 trillion funding line through the EFSF is deemed necessary to address overall European debt. Also, the possibility of Franco-Belgian bank Dexia failing, despite having passed stress tests a few months back, can create a Lehman-esque scenario in Europe.

Alternatively, a bailout by France and Belgium could spell disaster for these already debt straddled countries (public debt-to-GDP ratios of 80% and 81%, respectively, according to the IMF) with high Greek exposure wile on the verge of rating downgrades. With this type of uncertainty looming, staying on the sidelines out of equities, as our Trend Tracking Indexes suggest, is the most logical decision for the time being.

On the home front, as reiterated by Bernanke during his speech yesterday, U.S. growth is decelerating and avoiding fiscal consolidation is of paramount importance to prevent a further economic dip, supporting my current view that investors should steer clear of equity ETFs. The ineffectiveness of current policy tools combined with continued political deadlock won’t settle markets any time soon.

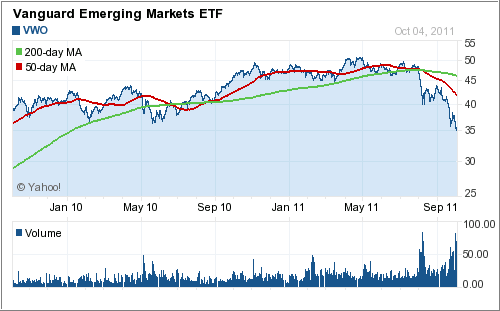

Although structural economic deficiencies in the developed world are front and center, diving into emerging market ETFs doesn’t protect investors from the potential contagion emanating from Europe. Case in point, Vanguard’s MSCI Emerging Market ETF (VWO) has experienced a $1.2 billion net inflow in the past week though it is below its 50-day and 200-day MA:

I want to stress that despite this “new normal” environment, the overheating in emerging markets and its vulnerability to a European debt pandemic, continue to support my decision to stay in cash or safer, albeit lower-yielding fixed income investments.

Contact Ulli

Comments 4

I like your work. Helps me.

Again, Ulli, I agree with you (and you aren’t paying me to write these Replies). I think the last 2 days are short-term up bumps in this Bear market, and probably we’ll get a few more. Investors who think the European problem is solved or contained are delusional. Dexia doesn’t have the cash to cover Greece, even if it decides it signs on the dotted line. As my ninety-two year old Daddy says, “You don’t have a deal, and talk is cheap, until money changes hands.”

Also, as you wrote, the Fed will help United States’ companies, but there is no way it is going to help in the European mess. Washington politicians would abolish the Fed, right now, in this political climate, if the Fed tried to get involved in the Euro mess.

The market acts on perception, though. But the perception of good news, when there is so much bad news will get investors perceiving the bad news, again, pretty soon, and the Bears will be back.

I think there are a couple of key support levels, for the market. If the S&P dips to 1101, I think it will go down to fairly quickly to 1000 or 950 or possibly 900. I think you are exactly right to steer clear of equity ETFs. Also, inverse ETFs are risky, and leveraged ETFs are like a gambling mentality, so I think people should always steer clear of them.

JC,

Exactly right. I am curious as to what the perception of tomorrow’s jobs report will be. Can a bad number possibly be twisted into something positive for the market?

Ulli…

As always, your generosity in sharing your knowledge and insight is much appreciated. I went completely to the sidelines August 3-5 and intend to remain there for now.