With the markets being stuck in a trading range over the past few weeks, it’s easy to forget to once in a while look at the big picture to see where we have been and where we might be going.

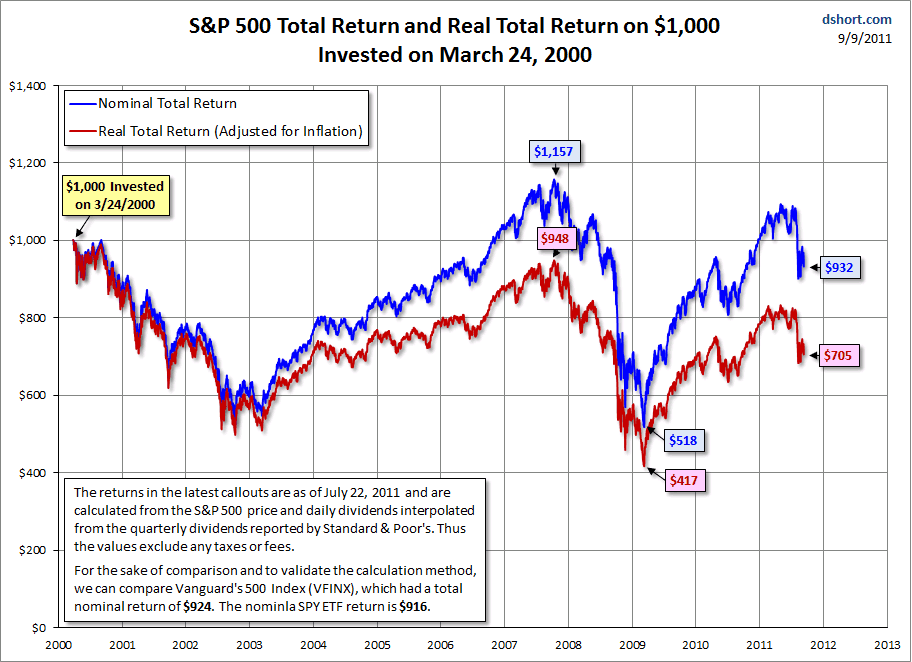

Doug Short produces some of the best charts in the business. He’s just updated the lost decade by comparing the S&P 500’s nominal return and the real total return, which is adjusted for inflation:

We’re now over eleven years beyond the S&P 500 2000 high. This little charting exercise gives credence to the frequent reference to a “lost decade” for investors. In nominal terms, the index is about 6.8 percent below where it was at the 2000 peak, but in real terms, it’s a disappointing 29.5 percent off the original investment. The chart also offers support for the wisdom of diversification across asset classes … and perhaps the value of active management during secular bear markets.

[Click on chart to enlarge]It’s not a pretty picture for someone who simply bought and held on to his portfolio for dear life. It also underscores the point that I have made repeatedly that it is far more important to avoid the big market drops than to participate in every up move the market throws at you. I have elaborated on that theme more in Downside Portfolio Protection.

Looking at the current global economic landscape, you can easily make the case for reduced economic activity, which translates eventually into lower stock prices. Throw in an unexpected shock event, such as a debt default by one of the weak EU countries accompanied by one or more bank busts, and you can see where the lows of 2009 could possibly be revisited or at least be approached.

With all that current uncertainty causing huge volatile swings in the market place, the future might look very similar to the past. To avoid going down with the next bear market, it’s essential that you stay with the major trends and deploy some sort of an exit strategy based on trailing sells stops.

Sure, as we’ve seen recently, no one investment approach is perfect and neither is trend tacking. However, I believe that, as long as we are vacillating between boom and bust cycles, it’s imperative that you apply some method to control the downside risk.

If you don’t, you may realize that a lost decade can easily turn into two lost decades (see Japan). If you only make modest returns during bull markets, but manage to avoid the brunt of bear markets, you will find out that you may be better off than the investor who aims for and, at times, gets high returns, but watches them evaporate when the bear rears its ugly head—whenever that will be.

That reminds me of a reader who called in early 2009. He mentioned that his advisor managed to get returns of 35% per year for 3 years in a row. Upon my inquiry as to why he was calling me, he said “last year I lost 80%.”

The lesson is that high returns don’t matter, unless you have a way of taking profits or limiting losses; otherwise, investing is simply a waste of time.

Contact Ulli

Comments 1

thank you ulli.