At the open, the markets looked downright ugly as the Dow was briefly down some 300 points before a slow rebound cut into the early losses.

Financial stability in Europe, or the lack thereof, along with a fallout from Friday’s poor unemployment numbers combined to support the bearish case for the moment. Yesterday’s pounding of the European markets caused by worries about a possible Greek default, which might threaten the solvency of a number of European banks, set the tone for today’s opening.

Well, if you missed it, Greek 1-year bonds are generating a yield of over 80%. Does anyone really think they won’t default?

So far, September is off to a bad start; actually it’s the worst since 2002 and it’s the fourth-worst ever.

It pays to be aware of the fact that the crisis in Europe is far from being over and a sudden event could drag down world markets without warning.

Additionally, domestic issues could add to global worries, which means this is not the time to engage in heroic investment endeavors. Play it safe, be hedged, out of the market altogether or, if you are holding PRPFX, watch your trailing sell stop.

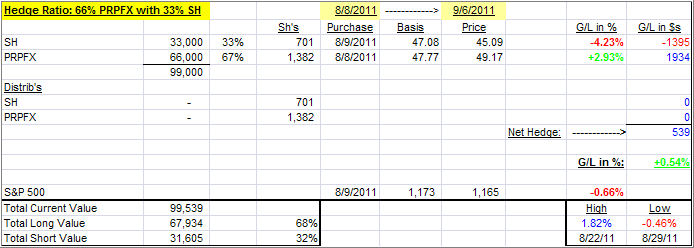

While our core holding PRPFX dropped -1.17% today, our short position offset that drop somewhat, which puts our hedge in the following position:

Our international TTI (Trend Tracking Index) remains stuck in bear market territory, but the domestic TTI slipped a bit with today’s sell off, but stubbornly remains on the plus side of the trend line by +1.15%.

That certainly is not enough to call the bearish phase from being over, so we will hold on to our hedged position until we get a better clue as to major market direction.

Contact Ulli

Comments 2

What are your thoughts concerning the swiss frank pegging their currency to the Euro. Might that not affect the performance of PRPFX into the future?

John,

As I said before, currency manipulation rarely works for any length of time. I will watch and see how things develop.

Ulli…