ETF/No Load Fund Tracker StatSheet

————————————————————-

THE LINK TO OUR CURRENT ETF/MUTUAL FUND STATSHEET IS:

————————————————————

Market Commentary

Friday, September 2, 2011

LOUSY JOBS REPORTS CLOBBERS MAJOR ETF INDEXES

While the change from last Friday’s close was only minor, it does not tell the entire story. A sharp rebound early in the week was completely wiped out as selling ahead of Friday’s jobs report indicated nervousness.

Rightfully so, as the shocking jobs report came out indicating that there was zero growth in August, while the unemployment rate remained at 9.1%. The major indexes dropped like a rock at the opening and never recovered.

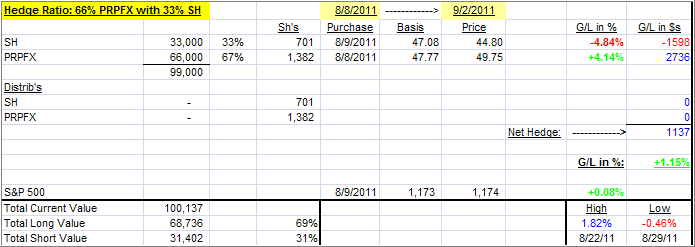

Gold rallied over 3% on the day, while interest rates dropped, and our core holding PRPFX bucked the trend by gaining +0.22%. It was a good day to be hedged, as the short component SH gained +2.59% putting our hedge into the positive by +1.15%, as the matrix shows:

This was the kind of day where both, the long and the short positions gained, which I expected in this current environment. For comparison, our ETF equivalent of PRPFX did even better by gaining around +0.95%. As I have said before, the ETF equivalent usually holds up better in down markets, but at times lags during up markets.

Our Trend Tracking Indexes (TTIs) meandered with the markets and are hovering above and below their respective trend lines as follows:

Domestic TTI: +1.35% (last week +0.69%)

International TTI: -9.42% (last week -10.03%)

The international TTI remains stuck in bear territory, while the domestic version is still hanging tough above the line. Again, I like to see more upside momentum, before I will surrender and call a new domestic ‘Buy’ signal.

Not helping the horrific jobs report were new worries about the European debt crisis as Greece admitted that it is not hitting its spending and economic goals, which may mean that the rest of the EU may not throw any more good money after bad.

None of the major issues that ail the global economies have gone away, although by the sharp rebound during the past week of August, you might have thought differently. My view remains the same in that I believe that there is more downside risk than upside potential.

The events of today may put the Fed back on the spot as Wall Street is sure to howl for another assist. However, right now, there is a long weekend ahead of us before Wall Street returns fully staffed on Tuesday.

It remains to be seen, if there is more of a spillover effect, but chances are that increased volatility will be again on the menu next week.

Have a great Labor Day weekend.

Ulli…

————————————————————-

READER Q & A FOR THE WEEK

All Reader Q & A’s are listed at our web site!

Check it out at:

http://www.successful-investment.com/q&a.php

A note from reader Kent:

Q: Ulli: In reviewing the 8/30/11 update on portfolios, I noticed the open position of SH is down almost 8%. I’m wondering if in your view, this qualifies it as a “sell,” under the 7% stop rule.

Thanks, when you get a minute.

A: Kent: The hedge is there for a reason, which is to cover downside risk by being neutral while providing us with potential profit opportunities when the markets correct, such as today. Consequently, I don’t use 7% on the short side, but work mostly with the direction of my Domestic TTI.

Right now, we’re stuck in the middle, although today was a perfect day for the short position, and I will remove SH next Tue/Wed, after the Labor Day, when the effects of today’s jobs reports have been absorbed—assuming that the markets hold up.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/

Contact Ulli