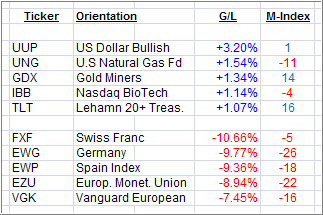

With Europe capturing most of the attention, although negatively, it’s no surprise that this area dominates the Laggards column.

With the Swiss attempting to peg their Francs (FXF) to the Euro, they took the top spot on the downside with a loss of -10.66%. Currency interventions rarely last for any length of time before they resume their natural trend. Time will tell if that will be the case again.

All other Laggards were individual European countries as well as Europe as a whole, when measured by VGK, which represents some 467 common stocks in 16 countries.

On the Leaders side, we had a shift from last week, as the U.S. Dollar was the beneficiary of the European debt saga, so it occupies the #1 spot. However, please note that UUP still hovers below its respective long-term trend line, which means it still has a ways to go before I would consider it as a ‘Buy.’

While UNG showed signs of life again, it’s M-Index is a weak -11, and it is also still stuck in bearish territory.

This is the time to stand aside and accept the fact that uncertainty may even kick up a notch, should event in Europe worsen. I am sure they will; the timing of it is just the big unknown.

Disclosure: Holdings in FXF

Contact Ulli