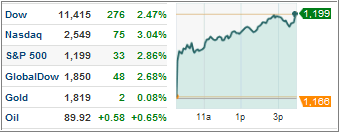

After 3 days of relentless selling, which caused the S&P 500 to lose -4.43%, it was time for a relief rally or possibly a dead cat bounce. The index managed to make up some of the recent losses by gaining +2.86% on the day as the chart, courtesy of MarketWatch.com, shows.

There were several supporting actors lending an assist as the rally got underway. The most important one was today’s ruling by Germany’s highest court that rescue packages for debt ridden countries are legal, but need to be approved in the future by a parliamentary panel. Translation: We are now in a position to legally throw more good money after bad; after all, Greek 1-year bonds are now yielding 98%…

Further supporting the rebound was President Obama’s expected $300 billion proposal to boost jobs, which is to be announced tomorrow night. Also helping was the Fed’s Beige Book report indicating that modest growth is to be expected, although housing is to remain weak.

While these are all nice reasons for optimism, they do not take away from the fact that, after getting pounded for 3 days, the markets were simply oversold and due for a rebound anyway.

With so much “encouraging” news, gold and bonds were the losers as suddenly uncertainty was put on the back burner, despite none of what ails the world has been resolved.

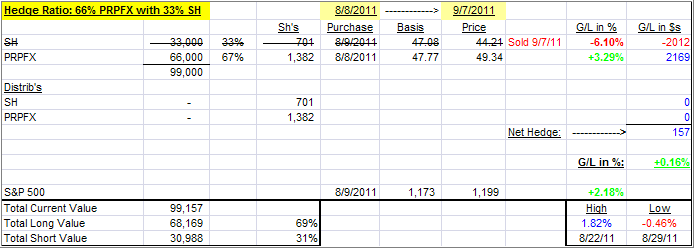

As the rally got underway, I sold the short position (SH) of our PRPFX hedge, which means we are now again net long. We simply had reached a point where the Domestic TTI stubbornly held on to its position on the plus side after having vacillated above and below it for a while. Since this hedge is designed to profit during downtrends, right now the follow through to the downside I was looking for did not happen.

That does not mean it won’t in the future, but right now, I have to acknowledge the fact that the Domestic TTI has spent more time slightly above the line than below it. Here’s how the hedge stands after today’s close:

I will consider initiating it again, should the Domestic TTI dip back into bear market territory. Obviously, with the benefit of hindsight, we would have been better off keeping PRPFX un-hedged.

It will be interesting to see if there is more follow through to the upside, or if we are heading back down the moment questionable news, especially out of Europe, make it to the front page.

Contact Ulli

Comments 2

How did the ETF version of PRPFX perform (bottom line) compared to the fund version? Did the separate ETF components perform as expected and desired? How did this rather short trial compare to the more extensive back-testing?

It is not clear to me why you decided to close the hedge at this particular moment, unless you had some indication that the recent period of extremely high volatility was over, or that PRPFX could handle big moves up or down.

Thanks

dg

David,

The performance was very similar. As I said, this hedge performs best when the markets head into bear market territory as determined by my Domestic TTI. While we saw a drop below the line, there was no follow through, as I had expected. With the TTI remaining stubbornly above the trend line, the hedge did not do much of anything so I unwound it for the time being.

Once the Domestic TTI drops back below the trend line, I will reconsider this type of hedge again. Yes, PRPFX has proven itself in the past to be a good contender in all kinds of market situations.

Ulli…