The markets stayed in rally mode for the third day in a row, supported by rises in Asia and Europe, along with the announcement by Google to buy Motorola Mobility. The major Market ETFs have now recovered all of their losses since the U.S. debt downgrade on August 5.

Despite this bit of euphoria, the problems that prompted the downturn have not gone away yet. A domestic recession is still the cards, and Europe’s banking system is in dire straits.

Technically, the markets remain in correction mode meaning the major indexes are still off their April 29 peaks by more than 10%. Maybe that explains that today’s volume was very light suggesting that there is not much conviction behind this up move.

Our Trend Tracking Indexes (TTIs) showed improvement as well and are positioned relative to their long-term trend lines as follows:

Domestic TTI: +1.51%

International TTI: -7.56%

As was the case last Friday, the Domestic TTI is still hovering above the trend line. For the moment, I am still sticking to the Domestic Sell signal from last week (effective 8/9/11), when this indicator dropped below the line, until I see a few more closes in bullish territory.

Should those materialize, we will have experienced a whip-saw signal (a ‘sell’ followed by a ‘buy’ within a short time frame) and will have to adjust our positions from neutral to bullish by eliminating the short component of our hedge.

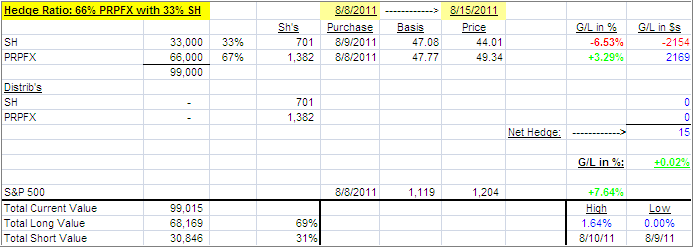

After today’s close, the current hedge remained just about neutral as the matrix shows:

With the domestic TTI doing the trend line dance, as I refer to it, it’s too early to tell if that dip into bear market territory was a head fake with the bulls now taking over again.

My preference, given the current facts, is to be a little late going all out long again in order to be sure we don’t get whip-sawed again when the downside comes into play. From a fundamental point of view, I see a few known uncertainties on the horizon, but it’s impossible to say when they will matter to the markets, however, sooner or later they will.

One banking failure in Europe (very likely), and we will head south again in a big way. In the meantime, I will sit on our hedged PRPFX position for a few more days, but there will be a point when we need to become outright long again.

Once that point has been reached, I will make the announcement on this blog.

There will be no Mutual Fund Cutline Report tomorrow, as I will focus more on daily market reports during times like these. Wednesday’s Model ETF Portfolio update will be posted as usual.

Contact Ulli

Comments 5

Ulli,

Would you direct me to any past articles that you may have written about how the US & International indexes are put together? My initial introduction to your newsletter years ago suggested that you were using certain mutual fund values. Is this still correct or have you changed your valuations to using ETFs? Thank you.

Ulli,

When we eventually get a buy signal, are you still an advocate of reinvesting in equities in 3 installments, as the market moves higher? (5% market increases)? Or do you just recommend that strategy for more conservative trend followers?

Thanks,

Paul

Stan,

I designed the TTIs back in the 80s, and their compositions are proprietary.

Ulli…

Paul,

It depends on your risk tolerance. I have produced my first video about that very topic. While it’s not posted at my site yet (it’s the first in an upcoming series), you may preview it here:

http://www.youtube.com/watch?v=69gNJ56EOGQ

Ulli…

Enjoyed the video. Thank you.