If the market swings and this enormous volatility leave you speechless, you’re probably not alone.

Based on today’s market activity, yesterday sure looked like a dead cat bounce. Contributing to the negative bias were recession concerns at home and the ever worsening debt crisis in Europe, for which there simply is no painless solution.

This is the type of market that moves with lightening speed supporting my often voiced view that you have to prepare you exit strategy during times of calmness. This assures that you don’t stress out when the heat is on and you simply focus on executing your trailing sell stops as they get triggered. That’s how things are handled in my advisor practice.

Our Trend Tracking Indexes (TTIs) slipped with the market confirming my opinion that we have entered bear market territory. Here’s are today’s closing numbers:

Domestic TTI: -1.03%

International TTI: -13.07%

S&P 500 200-day M/A: -12.88%

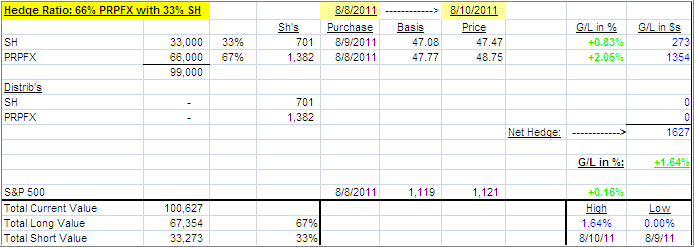

Our PRPFX hedge, which I set up yesterday, performed as expected so far. Here’s the matrix:

As you can see, the market drop helped our cause, and the hedge is up by +1.64% as both components are in plus territory.

There is no way to even attempt to make a reasonable forecast as to how low we can go or if there is and end in sight to this market debacle. To me, it does not really matter, what matters only is that we try to stay in tune with the major market trend, which is down at this time.

As long as this volatility is with us, I will be focusing more on a review of the day’s events and will only produce the Cutline reports as time allows.

Tomorrow, we’ll be facing jobless claims and June trade balance reports, and I am sure there will be more unknown uncertainties popping up out of Europe. This is the time to be concerned about portfolio preservation and not look for far out opportunities. Because right now, it’s very easy for investors to do something very stupid.

Contact Ulli

Comments 14

Ulli,

I have been following you for years, but have found your site confusing. I am out of my fund positions simply because they have all violated a 7% loss some time ago. Is your TTI flashing a sell yet??

Hi Ulli,

Appreciate all the info you provide!

How did you decide the 33% SH and 66% PRPFX ratio?

TIA,

Bill

You are the calm in a storm. Your stuff is so consistent. And free of emotion. Thanks for keeping me on your list. You are a treasure to keep on keeping on.

Dear Uli

It’s about time I thank you for your excellent newsletter. I have been supported by your views. I also use PRPFX as my key hold.

Continued success

John

Ulli, thank you. As a 73 year old retiree who has managed his portfolio for many many years, I am at peace. Thanks to you and the ETF Bully, I have an exit plan which is working wonderfully. This plunge is the first opportunity to use your Exit strategy and I slept like a baby through the volatile days past and those looming ahead. Just wanted to tell you so.

“Because right now, it’s very easy for investors to do something very stupid.” What a great ending! Thanks for all your effort in making the market fluctuations more understandable.

Hmmm, Ray, if you read my blog post every day, you should not be confused. I state clearly where we are in terms of market direction and that we recently entered bear market territory. Since you followed the trailing sell stops, you are exactly where you should be right now during this market craziness: Out of equities and in Money Market.

Ulli…

Bill,

One word: Testing…. 🙂

Ulli…

Kirby,

Thanks for the nod. Please spread the word.

Ulli…

Thank you kindly, John… do spread the word…

Thanks Dom; that is the exactly the idea: Be prepared so that you are not emotionally affected by ridiculous market behavior. Glad to hear you’re sleeping well… 🙂

Ulli…

Charlie,

Yes, it indeed is easy to get your head handed to you on a silver platter as outright longs and shorts can get clobbered in a hurry…

Ulli…

Ulli,

Can you point me to an up-to-date chart that shows all your buy/sell calls over the years, including the most recent one? I’d like to share it with some friends.

Thanks,

Scott

Scott,

Look at Friday’s StatSheet, sections 1 and 2, which shows both trend tracking indexes.

Ulli…