As you know from my Wednesday ETF Model Portfolio posts, my preference in my advisor practice is the use of portfolio #1, which includes a core holding in PRPFX, the only mutual fund I currently use and advocate.

During the recent market upheaval, PRPFX has held up extremely well and therefore has given us the type of portfolio stability I was looking for.

But is it a fund for all times and all scenarios?

If you look back to 2008, you will notice that PRPFX declined as well, but not nearly to the extent that the broad market did as measured by the S&P 500 (SPY). The 5-year chart below clearly demonstrates not only this point, but also underscores again the wisdom and benefit that limiting downside risk has its long-term rewards:

Still, I would have not liked to hold PRPFX through that crash. A better way, with the benefit of hindsight, would have been to simply hedge it. Ever since the 2008 debacle, I have played with various combinations of how a great fund like PRPFX could be hedged rather than sold, for the purpose of generating some kind of profit in a down market.

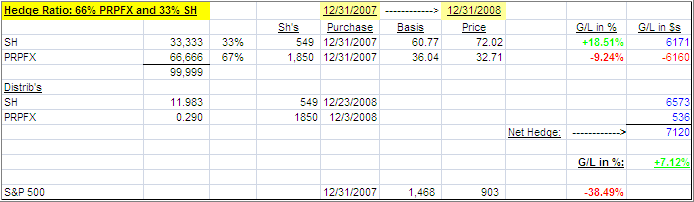

Take a look at the following back test, covering 2008, designed to demonstrate the best hedge for PRPFX, which I have found so far:

As you can see, PRPFX lost -9.24% in 2008 vs. the S&P’s -38.49%—a huge difference based on buy and hold. But, when adding SH (short S&P 500) to the equation and in the ratio shown, the hedge now produced a gain of +7.12%.

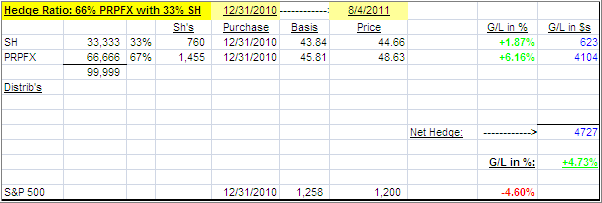

Let’s take a look at how this might have worked in 2011 YTD, since that is closer to current reality. Here’s the back test using the same scenario:

As you can see, at this moment in time, the hedge has produced a gain of +4.73% compared to a loss of -4.60% in the S&P 500. However, to be fair, this hedge at one time was slightly upside down as it lagged when the markets were in rally mode.

The best time to initiate such a hedge is when my Domestic TTI (Trend Tracking Index) has moved into bear market territory. From my experience, these hedges work better when used in a bear market. In a bull market, you may stay even or possibly drop slightly negative. During my tests in bullish environments, the worst drop I have seen was -2%.

Now let’s look at a real world scenario. It’s not back tested, but I actually set up this hedge in one of my personal IRAs during a bullish period that subsequently turned bearish. I am always in testing mode and like to do that with real money, once I am convinced the idea has merit.

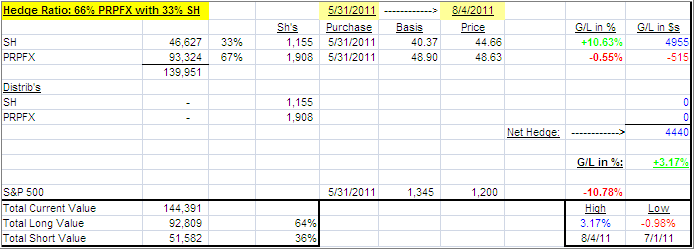

On May 31, 2011 I set up the following hedge:

I have updated this table every day and, as you can see in the lower right, this hedge made a low of -0.98% on 7/1/11 and a high of +3.17%, just this past week on 8/4/11.

Comparing this to the S&P 500’s loss of -10.78% over the same period, this clearly demonstrates the value of a hedge. Had you simply held PRPFX un-hedged during that time, you would have lost a negligible -0.55%—not bad at all.

When I set up this hedge on 5/31/11, I had no clue how it would turn out, but I will keep it in place until momentum indicators tell me that that the bull is still alive and has actually returned.

If you are a fan of investing in a quality fund such as PRPFX, this type of hedge might be a consideration for you. You can initiate it at anytime you are emotionally bothered by market activity. If it turns out that you were wrong, you can simply sell the short position and become again net long.

Here’s one thing I can promise you. If you are set up in a hedge like I am above, not much in the marketplace will bother you, and you will sleep well at night.

For the sake of disclosure, I have to tell you that these are my back tests and real investment experiences as indicated. There are no guarantees of any kind that the future will be behave similarly to the past, however it is my personal belief that a hedged position, as described, will reduce portfolio volatility as opposed to being outright long or short.

Contact Ulli

Comments 3

Ulli: Intersting post about hedging. Thanks a lot. One question:

If we use a double short to hedge, say SDS. then SDS may not always produce twice the inverse return of SPY over a period of time, am I right. If SPY loses 5% over a period, depending upon the path SPY took, the double short might be positive or negative.

Pleae correct my understanding: However, SH will always produce the inverse of SPY irrespective of the path taken by SPY. If SPY returns -5% over a time, SH will return 5%

Am I correct?

If this posting is unclear, Please do not post it.

Anon,

You are correct, which is why I prefer the use of SH over SDS.

Ulli…

Thanks Ulli. We talked about purchasing some SH, but did not concide it as a hedge against my PRPFX, which I have no plans in selling. Good idea.