ETF/No Load Fund Tracker Newsletter For Friday, August 19, 2011

ETF/No Load Fund Tracker StatSheet

————————————————————-

THE LINK TO OUR CURRENT ETF/MUTUAL FUND STATSHEET IS:

————————————————————

Market Commentary

Friday, August 19, 2011

FORECLOSING ON EQUITIES

The bullish start to this week has long been forgotten, as the major market ETFs got clobbered at the tune of -4.66% for the S&P 500. For the month, this widely followed index is now down by a mind boggling -13.00%, while our core holding, PRPFX, managed to slip only by a scant -1.43%.

Recession fears gripped Wall Street, and rightfully so, as stocks plunged sharply on Thursday, which was followed up by more bearish superiority on Friday. Domestic economic data showed a stalling economy, not just here but in Europe’s main engine, Germany, as well. The debt crisis is far from being contained and worries persist that primarily European banks will be adversely affected once the first domino starts to tumble.

Our Domestic Trend Tracking Indexes (TTIs) slithered further south and have reached the following positions below their long-term trend lines:

Domestic TTI: -0.99% (last week +0.82%)

Domestic TTI: -0.99% (last week +0.82%)

International TTI: -12.33% (last week -9.27%)

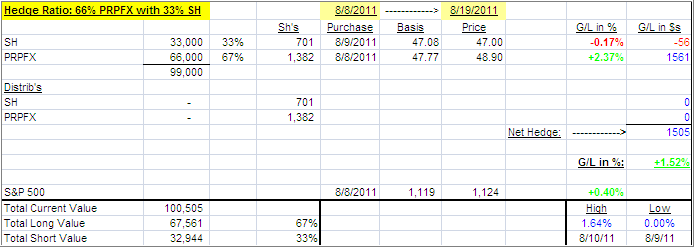

This dip further into bear market territory supported our PRPFX hedge, which shows the following result after today’s close:

So far, PRPFX has held up nicely on its own without any help from the short position SH. Should the markets continue the current path south, the odds of which I consider far better than 50/50, you will see SH’s performance kicking up a notch and lending an assist once PRPFX starts to slip.

While next week’s economic calendar is filled with reports about New Home Sales, Durable Orders, Initial Claims and the all important GDP, it will be the European debt crisis, which will take center stage. I expect some dramatic negative event to surface all of a sudden, which will have more negative consequences for those hanging on to equities. That is not a prediction, because I am not sure of the timing, but merely my opinion based on how I currently view the global landscape.

The best advice I can give during these times is for you to stay out of the market or in hedged positions. Outright longs and shorts can get killed very easily by extreme volatility.

Remember, right now, capital preservation should be your priority number one.

Have a great week.

Ulli…

————————————————————-

READER Q & A FOR THE WEEK

All Reader Q & A’s are listed at our web site!

Check it out at:

http://www.successful-investment.com/q&a.php

A note from reader Rahul:

Q: Ulli: I regularly visit theetfbully.com for your market analysis and insight. Last Wednesday, I saw your posting about 7 model portfolios. If I want to invest some money today, which model portfolio I should follow? I have some holding in PRPFX. My goal is to preserve capital as far as possible and to position for 7-10% gain yearly.

I appreciate your guidance.

A: Rahul: You should not invest in a new portfolio at this time. Wait till our domestic TTI signals a buy again. Right now, we’re sliding into bear market territory and have our #1 portfolio hedged as shown.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/

Contact Ulli

Comments 2

Ulli,

Your domestic and international TTI’s have both moved into bearish territory. However, your hedged portfolio only uses SH, a domestic short fund. Why don’t you also include short international funds, such as EFZ and EUM, in your hedged portfolio?

Tom,

I have not found a reliable approach to use EFZ and EUM.

Ulli…