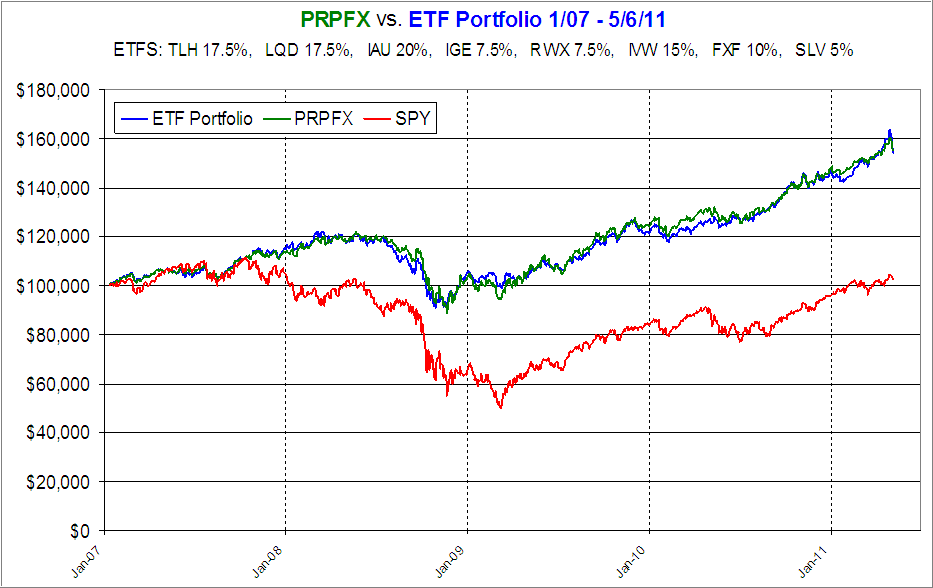

Much has been written about the creation of an ETF equivalent of the popular Permanent Portfolio fund (PRPFX). As you know from my Wednesday ETF Model Portfolio listings, a combination of PRPFX with a variety of ETFs has been my preferred mode of operation during these times of uncertainty.

From the articles covering the subject, none of them offered a graphic performance comparison to see how well an ETF equivalent would track the original PRPFX fund.

With the help of reader Richard, who is a far better chartist than I am, we created the following ETF combination and tracking chart while, at the same time, comparing the result to the S&P 500 (SPY).

Take a look:

[Click on chart to enlarge]

As you can see, the ETF equivalent tracks its mutual fund counterpart very well, although, if you look close, there are slight discrepancies. They are not large enough, however, to make this an issue to be concerned with, especially since the tracking period covers some 4-1/2 years.

Keep in mind, the idea here is to be in general directional alignment and not try to attempt to create an exact duplicate.

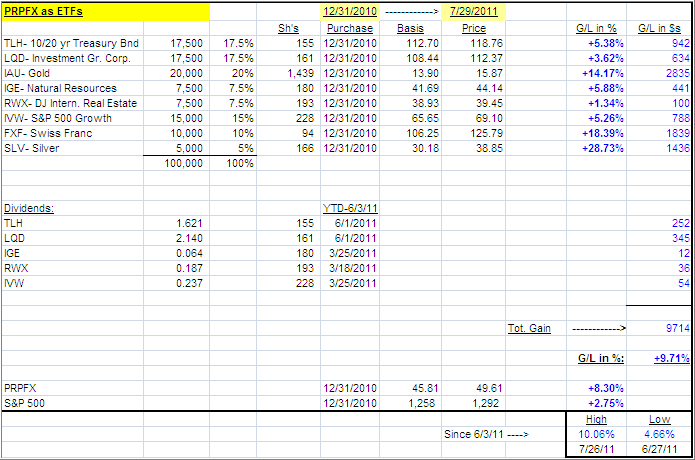

Let’s hone in and see how this ETF combination has fared YTD, when applying the same matrix as I use with our ETF model portfolios:

[Click on table to enlarge]As you can see, YTD, this ETF duplication has outperformed its mutual fund cousin by some 1-1/2%. I have been comparing the 2 since early June on a daily basis and have found that the ETF version has stayed ahead by about 1%, while slipping less during market sell offs. Obviously, there is no guarantee that this will continue in the future.

Nevertheless, since I use this combination in my advisor practice, I will add this ETF equivalent to my model portfolio collection as portfolio #7 starting next Wednesday. I will also elaborate on the trailing stop loss discipline to be used.

The obvious question in your mind might be as to whether you should use the mutual fund version or the ETF equivalent. While that is a personal choice, I use both in my advisor practice. Whenever I can, my first selection is PRPFX. However, I have a number of international clients (they are not allowed to invest in mutual funds), in which case I use the ETF equivalent.

If ETFs are your preferred investment vehicle, this may offer you a different approach to deal with the global uncertainties, which seem to have become a permanent sign of the times we’re living in.

Contact Ulli

Comments 8

I know you mentioned that you will discuss the trade stops for the Permanent Portfolio etfs in an upcoming blog, but is that what PRPFX does or do they peiodically rebalance? Thank you.

Sheryl,

I believe that PRPFX periodically rebalances.

Ulli…

I’ve noticed that some of the ETFs that you use in your portfolios cause K-1 forms to be generated at tax time, as opposed to the simpler to use 1099s. In a taxable account, I’ve found these to be a royal headache. I just wanted to suggest that you might take on that issue in one of your commentaries. And thanks for a terrific website. It is my daily choice for insightful market commentary!

Bob,

That is a very good point, however, most investors use tax deferred accounts when investing in such partnerships. I’ll write about it, as soon as I come across some updated materials on the subject

Ulli…

Hello, Ulli,

When choosing between PRPFX or the basket of ETFs equivalent, one might consider the following (assuming that both returns will be equal):

1. The expense ratio for PRPFX is 0.78% per year, whereas the basket clocks in at only 0.34% (based on the weight of each ETF ).

2. PRPFX can usually be purchase without a transaction fee. ETFs require paying a commission (an unbeatable 2 [two] dollars per transaction at Vanguard).

3. When selling PRPFX, there may be a back-end fee, or brokerage-imposed fee, for short-term trading (less than 6 months at Vanguard); free otherwise. Commission fees apply for exiting ETFs, but time held is not an issue.

4. If/when PRPFX rebalances, it’s done by the fund, whereas one needs to keep up with it (quarterly?) with the ETFs basket. Rebalancing the basket will again incur commission fees.

5. And, of course, there’s the ability to trade ETFs while the market is open, if that’s a personal importance.

The deciding factor may just come down to how much of that 0.44% expense difference in the two scenarios one believes would be eaten up by the added expense of periodically rebalancing the ETFs basket, and if the net savings is worth one’s time and effort.

Any holes in my thought process here?

Thanks.

Guy

Guy,

I have no issue with what you are saying. I think one can nickel and dime this to death; in the end it comes down to preference.

Ulli…

Just a comment from the UK:

Thanks Ulli again, for your continuous stream of high value “freebie” advice. The main atttraction of your PRPFX workaround for me is the chance to hold this portfolio in a UK SIPP (Self Invested Pension Plan). I have not yet found a way to do that with the Original but would appreciate, if another reader has more information about this.

Best wishes from the stumbling “old continent”

NK

NK,

If you have ETFs available,, you could use the PRPFX equivalent as I posted about last Sunday:

https://theetfbully.com/2011/07/reviewing-the-etf-equivalent-of-prpfx/

Ulli…