Closing the month of June with a bang and stepping into July with equal force, the major market ETFs have been on a tear for five days straight. How much of that momentum can be maintained is everyone’s guess.

The ETFs under discussion last week (TMW, VTI, VUG) rallied strongly and ended up above the listed +20 positions, so they are no longer visible on this report. If you care to track any of these, you now need to consult the Master ETF list. This will be necessary, whenever an ETF you follow has moved off the cutline table.

You can find the latest Master ETF list in last Friday’s StatSheet (section 3).

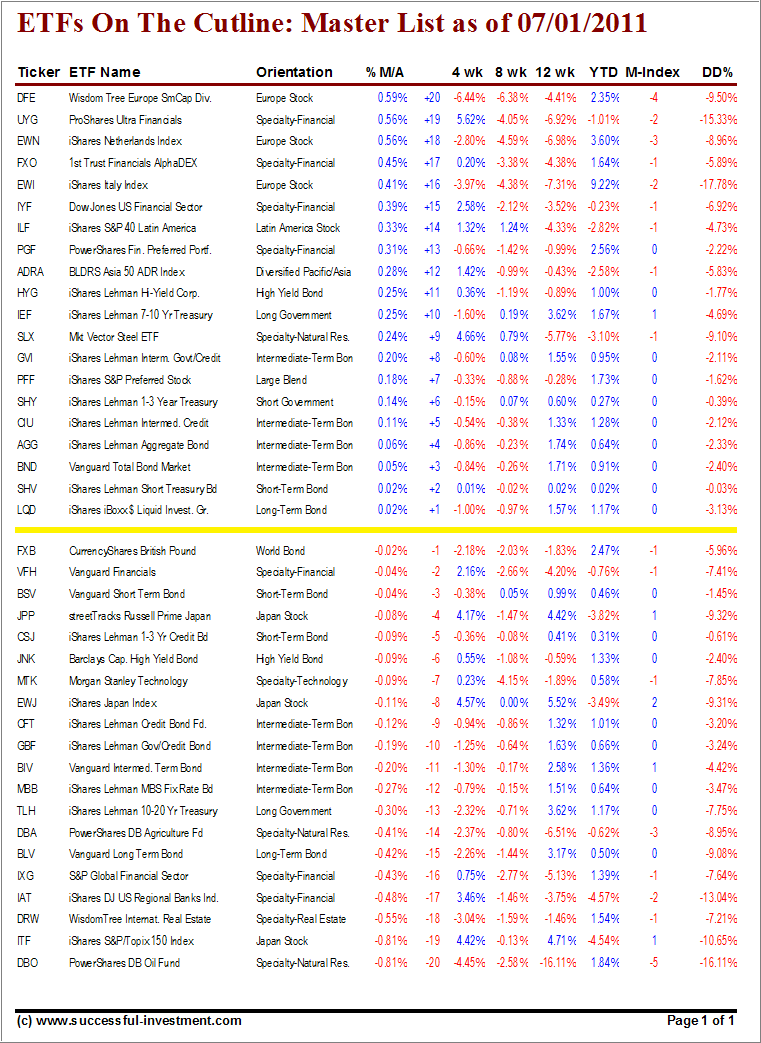

Take a look at the table:

[Click on table to enlarge, copy and print]

Moving back up above the trend line was heavyweight ILF (Latin America), which was stuck below it for quite some time. However, momentum numbers are still weak, and the break above the line was only a meager +0.33%.

After the markets having lost the past 7 out of 8 weeks, it will take more work on the upside to restore confidence that the bull still has stamina.

Reference: “How do I use the ETF Cutline Table to make a Buy decision”

Previous posts:

ETF Cutline Post as of 6/24/2011

ETF Cutline Post as of 6/17/2011

ETF Cutline Post as of 6/10/2011

ETF Cutline Post as of 6/3/2011

ETF Cutline Post as of 5/27/2011

ETF Cutline Post as of 5/20/2011

ETF Cutline Post as of 5/13/2011

ETF Cutline Post as of 5/6/2011

ETF Cutline Post as of 4/29/2011

ETF Cutline Post as of 4/21/2011

ETF Cutline Post as of 4/15/2011

ETF Cutline Post as of 4/8/2011

ETF Cutline Post as of 4/4/2011

Disclosure: Holdings in VTI

Contact Ulli