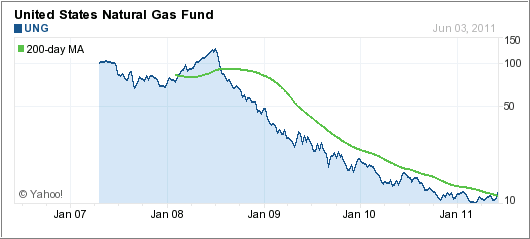

On several occasions, I have posted about the United States Natural Gas Fund (UNG) as having been the biggest losing ETF of the past few years.

It recently broke its long-term trend line to the upside by +3.48%, while its momentum numbers have improved and are showing the following results:

4-wk: +8.45%

8-wk: +12.76%

12-wk: +14.71%

YTD: -0.42%

Performance for current Buy cycle from 6/3/09: -58.29%

DD% (DrawDown): -62.44%

The 5-year chart above, courtesy of YahooFinance, confirms the turnaround. Is this finally the time to buy UNG?

First, this ETF invests in the near-term futures market, so there is an every present danger of performance limitations and volatility due to contango, as contracts get rolled over.

Second, this fund has just come out of a long-term bear market and it’s uncertain if this is just another dead cat bounce.

However, I can’t overlook the fact that a trend line crossing has occurred, which puts it into buy mode. If you have an aggressive component in you risk profile, you may want to consider some small exposure, but be sure to use my recommended 10% trailing sell stop, just in case UNG heads south again.

Disclosure: No holdings

Contact Ulli

Comments 2

I have been recently to a discussion held by analysts of a major Swiss Investment Bank. They consider Russia to represent a good opportunity even in the present

turmoil.

Riccardo,

Personally, those types of opinions are useless in my view. I look at trends in the market place, and the Russia ETF (RSX) has been going nowhere this year when you look at the momentum figures. They are all negative, however, RSX has just crossed above its own long term trend line by a scant +0.22%. I need to see a lot more follow through before considering it investment quality.

Ulli…