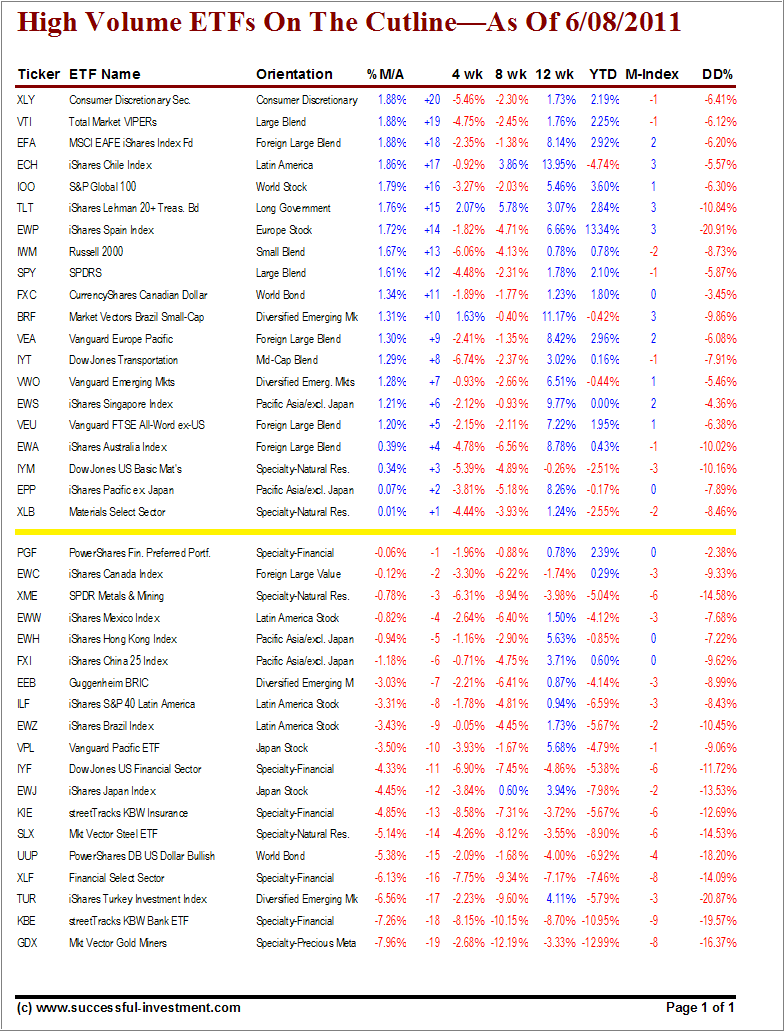

With the continued selloff, today’s High Volume ETF Cutline report offers some interesting insights in where the markets might be headed.

To clarify, High Volume (HV) ETFs are defined as those with an average daily volume of $10 million or higher.

These ETFs are generated from my selected list of 90 that I use in my advisor practice. It cuts out the “noise,” which simply means it eliminates those ETFs that I would never buy because of their volume limitations.

We had some major index ETFs showing tremendous weakness by dropping in on our cutline report from a level above the first positive 20 positions listed. That is not a good sign, if you are bullish and have no exit strategy.

Let’s start at the top:

The Major Market Index (VTI) dropped to a level of +19, compared to SPY at +12.

The Russell 2000 (IWM) ended up in the +13 position.

The Foreign Large Blend (VEA) slipped to +9, while VEU settled at +5.

The Dow Jones Transportation (IYT) dropped to +8.

The Emerging Markets (VWO) ended at +7.

Pacific Asia (EPP) slid to +2.

These major index ETFs represent a broad spectrum of heavily traded worldwide equities, and they are all within shouting distance of breaking into bear market territory. Even the currently highest ranked one, VTI, hovers only +1.88% above its long-term trend line (cutline).

First, take a look at the table and then read my latest market commentary:

[Click on table to enlarge, copy and print]All of the ETFs described above are major players, and all are heading south at the same time, although at varying degrees.

That is not a good sign and, if the markets don’t find some stability at these levels pretty soon, and continue to slide, you may find yourself getting stopped out of most of your positions.

At this point, odds of a new bear market have increased tremendously, and I suggest you monitor your sell stops very closely. As of yesterday’s close, our international Trend Tracking Index (TTI) is barely hanging on in bullish territory (+0.32%), while the domestic TTI remains stronger and has reached a position of +2.83%.

If you are a new reader and missed the original Cutline report, which also featured some “how to use” information, please review it here.

Quick Reference:

Disclosure: Holdings in VEU, VWO, VTI, EPP

Contact Ulli

Comments 2

Dear Uli,

i have read your newsletter and have used it successfully for over 10 years. Now i also read the “cutline” one. It is very good, but i think the font of the cutline list needs to be much larger. I am not sure if this a problem with my laptop, but even after clicking to enlarge, it is still too small to read comfortably. Just a suggestion, i hope you will accommodate … thanks.

Rajiv,

Hmm, if you click on the report that enlarges it to a very readable size, which makes it legible on any size screen.

Ulli…