A big tip of the hat goes to reader Richard for sharing his back testing results of the Ivy ETF Portfolio. Richard is a far better chartist than I am and has thrown me an assist on some occasions. He writes as follows:

There are several details to be aware of, as I tried to keep it simple/rule-based:

1. No sell stops used – only 195dma on each asset class.

2. IVY chart starts on 4/10/07 because that was the inception date of BND.

(Could go back further with substitute funds, but this was a quick first cut.)

2. For the 195dma Buy/Sell trigger, I tried to simulate your real world monitoring of the 195dma buy/sell. To avoid short-term daily whipsaws as the index first goes through the 195dma, I set it up so the Sell was triggered only when the ETF makes 10 consecutive closes below the 195 dma, and likewise the re-entry; Buy after 10 consecutive closes above the 195 dma.

At first this seems too risky, but I looked at market cycles going back many years, and as the index meanders +/- around the 195 dma, this still catches the major trend and often better than a quicker move, and greatly reduces whip saw transactions and filters out some noise. I can adjust this to any # – and really in practice look at other factors also.

Let’s look at the chart:

[Click on chart to enlarge]

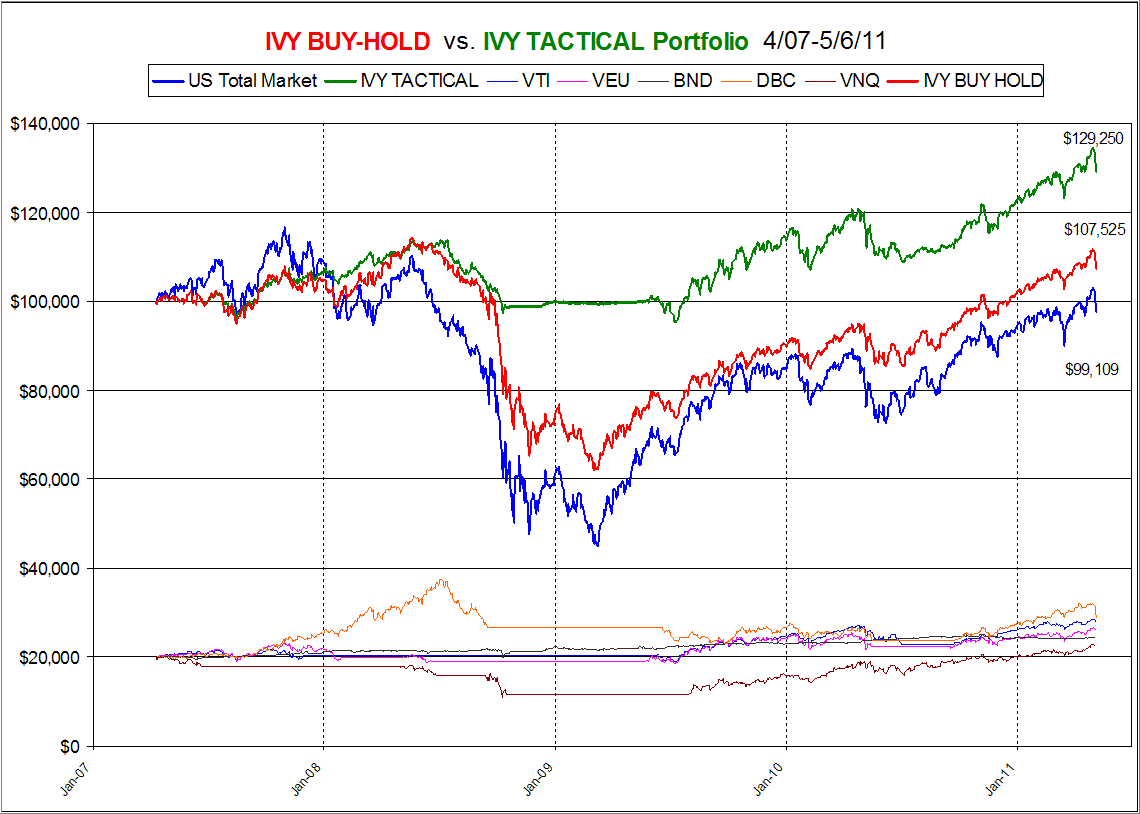

As you can see, Richard presents 3 different outcomes:

1. The performance of the overall stock market via the Total Market Index (blue)

2. The performance of the Ivy ETF portfolio as a buy-and-hold scenario (red)

3. The performance of the Ivy ETF portfolio with the trading rules as described above (green)

The differences are not surprising as the Ivy ETF Portfolio with its tactical (trend tracking) approach came out ahead – thanks to the 2008 market crash. For the sake of disclosure, I am obliged to point out that this past performance is not indicative of any future results.

However, this goes along with my long held belief that avoidance of any bear market should be an investor’s primary goal.

The above return of the U.S. Total Market Index (blue) clearly shows that, despite much hype in the press about the rally of the past 2 years, no gains have really been accomplished. The time has only been spent by the buy-and-hold crowd making up losses; and nothing more.

The above picture is worth a thousand words. Again, I thank Richard for his efforts.

Contact Ulli

Comments 12

195 dma?

Should have just googled it. 195 day moving average

Regarding the 195 day moving average:

I’ve also checked other moving average durations over many market cycles

to use as a buy/sell indicator – but the 200 dma (or 195 dma) still seems to be

more useful, as it seems to capture the major intermediate-to-longer trend best,

as far as I have seen.

Thanks Ulli –

Richard,

Over the past 20 some years, I have found that to me true as well.

Ulli…

During the 100% cash time, instead of holding actual cash, what do you think of a 100% hedged position of, say, 50% SHY and 50% GLD, to try to maintain the purchasing value of the cash? Any other cobination make sense? Thanks.

John,

Generally, I go to all cash when the TTIs cross to the downside. Some hedged positions may make sense, although I have never tested GLD and SHY.

Ulli…

How often did you rebalance?

Bill,

Hmm, rebalance the model portfolios? Depends on market behavior; I don’t have a set rule. I prefer to let the winners run until we get stopped out.

Ulli…

Hi Ulli,

Thanks for all the hard work. I am wondering where to find your portfolios on the site. On a previous post you stated that the you would be listing the IVY ETF portfolio as #6. Can you tell me where to find it?

Thanks,

Ilsa

Ilsa,

Sure; the model portfolios are updated every Wednesday. You can scroll back through the posts to last Wednesday and locate it. Here is the latest link:

https://theetfbully.com/2011/05/6-etf-model-portfolios-you-can-use-updated-through-5102011/

If you are signed up for my newsletter, you will get an email as to when they are posted. Go to the NL sign up page and enter your email.

Ulli…

Re: Rebalancing Results for IVY portfolio:

I’ve checked the effect of annual rebalancing on IVY (and other) portfolios,

and have found that it can have limited effect compared to the effort, as

sometimes it helps, and other times underperforms.

But in this case, it helped a bit. For the cycle shown, annual rebalancing

(on Jan 1-2) helped the IVY portfolio achieve the following:

Total Market (VTI) Buy Hold: -0.9%

IVY Buy Hold: + 7.5%

IVY Tactical (w/195DMA): +29.2%

IVY BH + Rebalance: +11.8%

IVY Tactical + Rebalance: + 32.9%

During the whole market cycle you can see (on the chart) that sometimes

it underperformed also.

Richard

Thanks for the clarification Richard….

Ulli…