This past week’s pullback in the markets clearly affected the High Volume ETFs as well. To clarify, High Volume (HV) ETFs are defined as those with an average daily volume of $10 million or higher.

These ETFs are generated from my selected list of 90 that I use in my advisor practice. It cuts out the “noise,” which simply means it eliminates those ETFs that I would never buy because of their volume limitations.

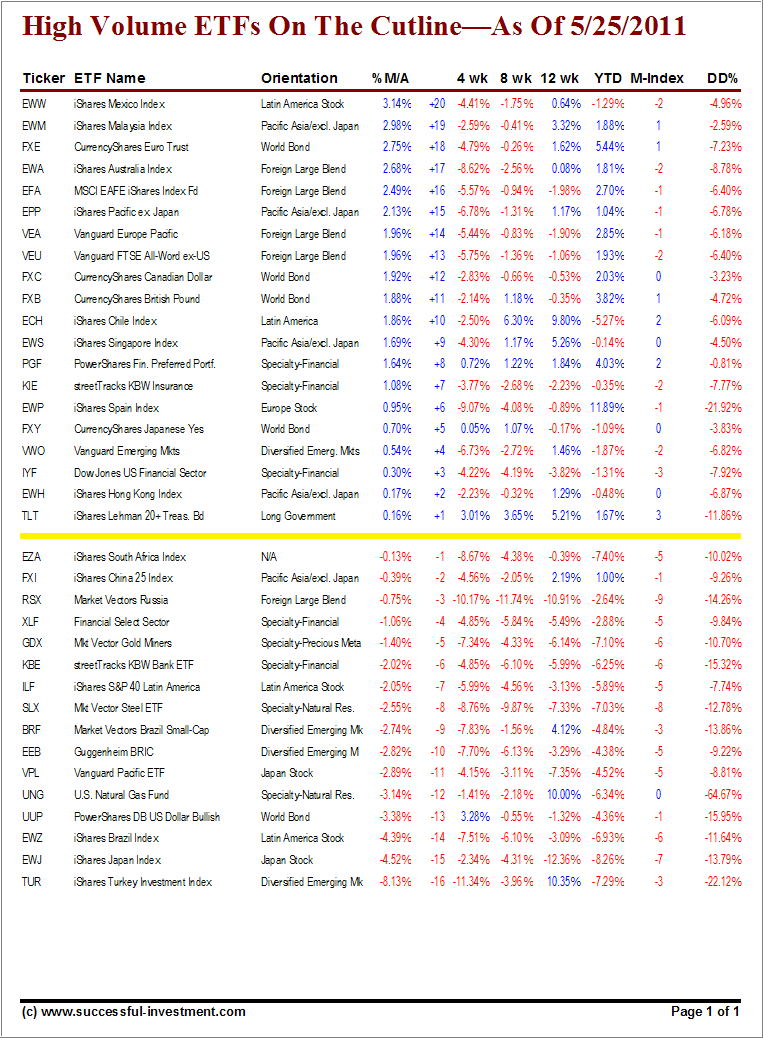

When markets correct, you can easily spot the results around the cutline (trend line), especially with those ETFs that have marginal momentum figures to begin with. They are the first ones to succumb to bearish forces. As a result, downward momentum pushed some ETFs below the yellow line and others deeper into bear market territory.

Here are some of the more dramatic moves:

Singapore (EWS) from +20 to +9

Spain (EWP) from +18 to +6

Emerging Markets (VWO) from +12 to +4

Slipping below the line were the following:

South Africa (EZA) from +8 to -1

China (FXI) from +4 to -2

Russia (RSX) from +3 to -3

If you look at the table, you’ll notice that currently only 1 equity ETF offers a buying opportunity, because of its positive momentum numbers all the way across and a low DrawDown (DD% column):

[Click on table to enlarge, copy and print]

Yes, PGF (+8) has descended from the level above the +20 position it held last week and has appeared on the screen again. While it has weakened, along with all other equity ETFs, it still represents a buying opportunity for new money, provided you use my recommended sell stop discipline.

You can never be sure if the market’s search of finding a footing over the past 2 trading days will actually result in another move up or turn out to be just another dead cat bounce. If your risk profile has you on the conservative side, you should pass on this one and wait for more upside confirmation before making new commitments.

If you are a new reader and missed the original Cutline report, which also featured some “how to use” information, please review it here.

Quick Reference:

Disclosure: No holdings in discussed ETFs

Contact Ulli

Comments 2

Ulli,

You’ve screened a position & it looks good, it meets your criteria for a buy. Then market goes south triggering a sell. Whe the market is in a confirmed rally is your strategy to re-enter the same position or are you screening for new funds ?

Thanks for sharing your opinion.

Brad,

Either way; there is no hard and fast rule. If no other ETFs are showing good momentum figures, I may repurchase the one I got stopped out of if and when it takes out the high that was used as a basis for the sell stop.

Ulli…