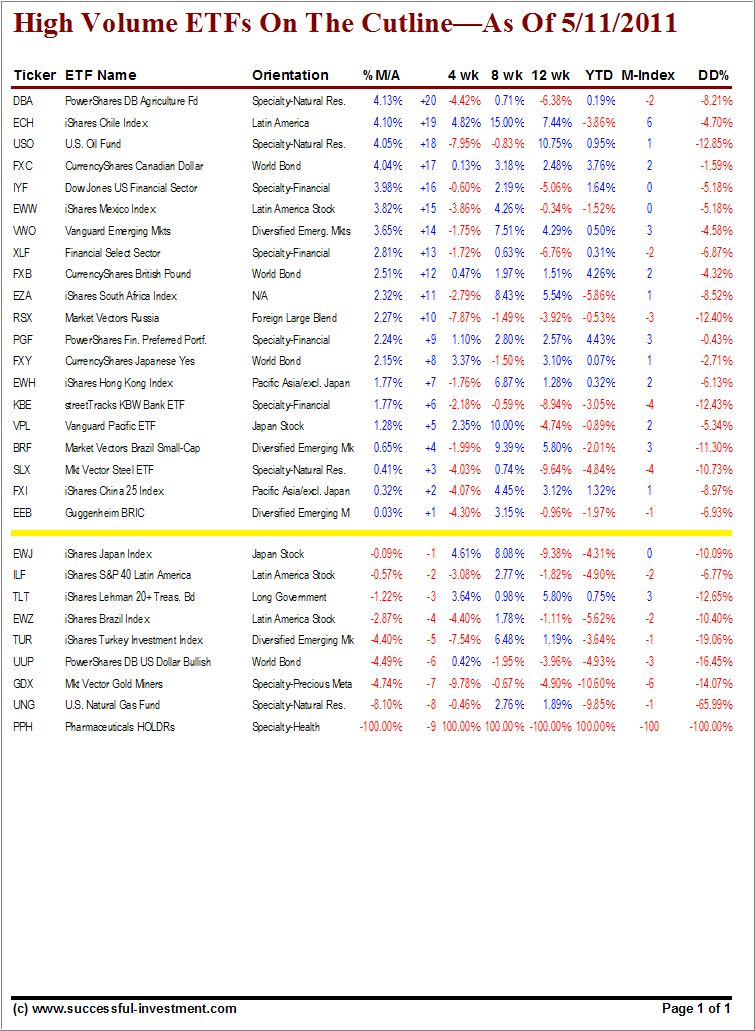

Here’s the latest update of the High Volume ETFs, which are hovering within 20 positions below and above their cutline (trend line). High Volume (HV) ETFs are defined as those with an average daily volume of $10 million or higher.

These ETFs are generated from my selected list of 90 that I use in my advisor practice. It cuts out the “noise,” which simply means it eliminates those ETFs that I would never buy because of their volume limitations.

Yesterday’s sell off caused several ETFs to drop down from a level above the +20 that are listed. Two of them are the U.S. Oil ETF (USO) and the South Africa Index (EZA).

Emerging markets (VWO) held up fairly well by dropping only from last week’s +16 to the current +14 position. RSX and SLX slipped but managed to stay above the cutline. Making a move from -2 to +4 was BRF, but it remains very close to the yellow line, just like ILF, and can therefore change positions quickly.

Looking at the juggling that went on above the line and reviewing all momentum numbers, there is only 1 ETF, which would qualify as a contender for new money.

Let’s look at the table first:

[Click on table to enlarge, copy and print]It’s the same ETF from last week, namely PGF, which actually improved its position from +7 to +9. All momentum figures have remained positive across the board, and PGF has come off its high by only -0.43% (DD% column).

If you have new money to invest, this might be a good selection, subject, of course, to my recommended sell stop discipline.

If you are a new reader and missed the original Cutline report, which also featured some “how to use” information, please review it here.

Quick Reference:

Disclosure: From the ETFs discussed, we have holdings in VWO.

Contact Ulli

Comments 2

Ulli:

Looks like a data feed error on PPH – it is well above its 39-wk ma…

Anon,

Just as in my StatSheet, -100% numbers merely mean that current data was not yet available when the report was prepared.

Ulli…