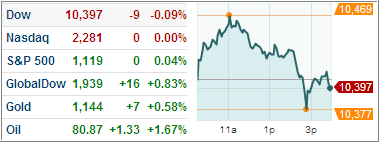

In an almost identical performance from the prior trading day, the early rally attempt on Wednesday was rebuffed, and the major indexes ended up essentially unchanged.

For the time being, it seems that selling sets in when the S&P; 500 moves to its resistance level in the 1,125 area. Even decent economic news could not prevent the slide.

Maybe it’s the calm before the storm on Friday when the Labor Department issues its nonfarm payroll report. Economists predict a loss of 75,000 jobs in February in part due to the winter storms.

If this number comes in much better, we might see another attempt to break through the S&P;’s resistance level. If it comes in much worse, we could see more acceleration to the downside. Again, there is no reason to make quick, irrational decisions; let the market come to you and execute your sell stops if/when necessary.

Contact Ulli

Comments 5

I see the dearth of comments, and have come to believe that when the market is doing pretty well, no one comments!

So here's a question for you, Ulli-At what point might you decide that we are in a narrow trading range 1080-1150 on the S&P;, and just buy JNK for it's yield?

Chuck,

I already own JNK for its yield and appreciation.

Ulli…

Ulli,

Looks like the 39 or 40 week or 200 day SMA line for Wilshire 5000 symbol $WLSH on StockCharts.com is still headed up and that may bode well for some time yet, I personally wouldn't be too alarmed until that line is crossed. Yes the 7% trailing stop is also very important even if it is just a mental stop and not actually entered if one is using a mutual fund.

Ulli,

I just follow the trend of the general market using a timing service that some people question, but works anyway regardless of what they say and a certain chart pattern and really pay no attention to the day to day noise from the two major financial news networks or the people who do a lot of writing on this blog that may not recognise a dollar if they saw one. I have been invsting since 1967 and do know what I am talking about as I have been thru several bear markets as well as bull markets. The trend is all I need to know and what to buy is much easier to figure out.

Julie

Julie,

Please dont keep us in suspense. What is the name of the service you use. So it got you in and out of the big bull and bears over those 35 plus years? That is wonderful for you. Congrats…