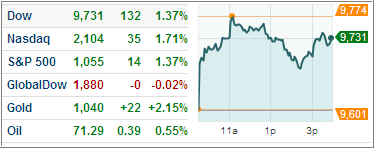

The markets rallied for 2 straight days and made up the losses of the entire last week, which puts us now back within striking distance of the psychological Dow 10,000 barrier.

Gold hit a record yesterday as the dollar weakened. The widely held GLD gained 2.46% on the day. As I posted about last week, we are participating in the metals and some currencies in a more conservative fashion via PRPFX, which gained a more modest 1.09% but is up over 9% since we bought it in early June.

Some mutual funds/ETFs are simply better suited for trend tracking than others. They tend to have less erratic swings by moving somewhat slower to the upside, but they also don’t crash to the downside. These slower moves avoid whip-saws and let us stay aboard a lot longer than we would with more volatile funds/ETFs.

A good way to avoid fast moving ETFs and mutual funds is to drop down the M-Index rankings when analyzing the weekly StatSheet. If you are an aggressive investor, you can consider selecting some of the top ranked ETFs, but be aware that frequent whip-saws, whenever the markets correct, will be part of your investing life.

If you are more conservative, go further down the list and, while your upside will be more limited, so will be your downside. As I said before, it all depends on your individual risk tolerance.

Comments 1

Ulli,

I have found that an ETF symbol VXF works very well as a highly diversified investment for me when the trend is up. I understand that it consists of the Wilshire 5000 index minus the S&P500; which makes it the Wilshire 4500 Extended Market index ETF. Sometimes rather than buy the QQQQ, IWM, SPY etc. I sometimes just buy this one if I only have $5,000 to $10,000 left over from something or some new money to invest.