My latest No Load Fund/ETF Tracker has been posted at:

http://www.successful-investment.com/newsletter-archive.php

Renewed optimism pulled the markets out of the doldrums of the past four weeks. All major indexes gained sharply.

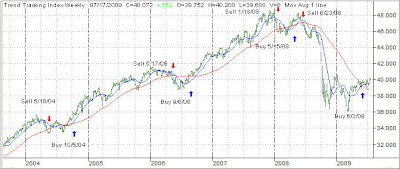

Our Trend Tracking Index (TTI) for domestic funds/ETFs has now crossed its trend line (red) to the upside by +3.07% keeping the current buy signal intact. The effective date was June 3, 2009.

The international index has now broken above its long-term trend line by +10.82%. A Buy signal was triggered effective May 11, 2009. We are holding our positions subject to a trailing stop loss.

[Click on charts to enlarge]

For more details, and the latest market commentary, as well as the updated No load Fund/ETF StatSheet, please see the above link.

Comments 2

Ulli,

Out of curiosity how many funds did you start out with in each of the Domestic and the International portfolios and how many do you still own in each that haven't stopped out? The reason I ask is that everyone talks about stops as if the are some sort of magic, but most people that I talk to and it is many, say that most every time they use stops they seem to get triggered. One can actually go broke using stops just like a person that doesn't use them can.

Anon,

As I said before, most client positions were hedged so we did not have a sell stop issue. We had one broadly diversified international ETF, which we established when the buy signal was triggered, and we were stopped out June 24.

I must tell you, that I handle various 401ks, where we did not have ETF choices, and I had to use mutual funds. In most cases, the funds were more stable, and we did not get stopped out yet despite the major indexes losing four weeks in a row.

Ulli…