Several readers have shared their experience in setting up a SimpleHedge as per my free e-book. The latest comment came from Foster, who wrote the following a few days ago:

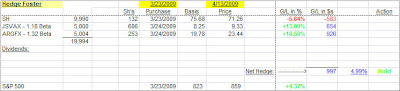

I bought SH @75.68 on the Monday (March 23) following your signal. Then JSVAX following day (March 24) @8.25 and ARGFX also on March 24 @19.78. Total investment (about 10% of portfolio) split 50% SH and 25% each the long funds.

Results April 13:

SH -5.02%

ARGFX +18.5

JSVAX +13.09

I’m now going to rebalance per your guidelines.

To better understand what he has done, I have applied my matrix to demonstrate his hedge:

[Click on chart to enlarge]

Foster was very aggressive with his fund selection ARGFX, which has a Beta of 1.32. While this fund will do well when the markets advance, it may decline faster as the markets retreat. At least that what theory tells us. Nevertheless, he has done extremely well during this short period of time and actually outperformed the S&P; 500, although he was well hedged against any adverse market moves.

Foster was kind enough to allow me to publish his experience, and I will track it in the future to observe the effect of different market conditions as time goes on. It is important for Foster to track his unrealized gains (right now at +4.99%) in order to apply his sell stop down the line.

If this current +4.99% was the highest unrealized gain so far, then his trailing stop loss would be 7% below that point, or at around -2%. If his high so far had been +6%, for example, his sell stop would be triggered if the hedge moves down to -1%.

This means that Foster’s aggressive move with his fund selections has put him in a position where he has very little downside risk. Nice job and thanks for sharing.

Comments 11

Ulli,

Very nice article today in your much appreciated blog. After checking on my Scottrade account website I fine that I would have to hold NTF (no trading fee funds) at least 90 days to avoid an early resemption fee of $17, the one exception that I have used are the Rydex index funds which Scottrade allows to be traded with no fees or holding period. So my question is this, I checked out some ETFs with the following symbols VXF QQQQ IWM MDY and they have a beta slightly above 1.00 so would any of those fit your requirements for hedging, it seems that they would? That would eliminate the concern about holding periods when one would need to rebalance. They would have a $7 commission to rebalance, but that is better than the $17 mutual fund redemption to sell only.

Thanks so much,

T.M.

TM,

Yes, they should work as well since their Beta is above 1.

Feel free to report your experience if you like.

Ulli…

I have a few questions for Foster if he would care to elaborate:

1.) Did you deliberately purchase the short on a day when it was down and the longs the following day when they were down (deviating from the standard SimpleHedge steps) in an attempt to maximize your starting point?

2.) As the fund JSVAX does not appear on the statsheets, how did you come to choose it?

Thanks,

G.H.

G.H., I bought SH on Monday following the buy hedge signal. As the market was going way up all day Monday, I decided to wait til just before the close. Then, I decided to wait until the following day to buy the 2 longs because there was at least a 50-50 chance the market would drop some following a huge up day.

To pick my longs, I used the Fidelity screener to identify domestic diversified NTFs with a beta above 1. Of the 30 or 40 that showed up, I decided to go with one having a high beta (Ariel beta 1.32) and one with a less volatile beta (JSVAX beta 1.18 aprox). I had owned these before in good times, so I just picked them without very much further thought (probably not a good idea!).

Foster

Foster, thanks for the reply.

That was a smart way to set up the hedge, effectively “front-loading” the hedge at the start. I hadn’t even thought of trying such a thing because I am dreadfully cursed when I attempt anything remotely resembling market timing.

I concur with your fund selection criteria, and I believe the spread between fund beta’s is a good way to set things up. In hindsight I feel I may have gone too far by selecting not one but both funds over the 1.2 range.

Another question, this one regarding your rebalancing: how are you going to do it? My reason for asking has to do with short-term redemption fees that might apply to the funds side of the hedge. My thinking is that it would be less costly simply to add to the short ETF rather than shed a small portion of the long funds. What’s your plan?

Continued success,

G.H.

Foster: Many many thanks for your kind reply and for sharing your insights.

GH,

Adding to your conversation with Foster. Yes, to avoid any early mutual fund redemption charges, which would apply if you re-balance, I’d make the adjustment with SH only. The goal here is to re-balance the hedge to its 50/50 ratio and not have it represent an exact percentage of your portfolio.

Ulli…

Thanks for the clarification Ulli, that is a big help.

I have another question that I don’t think was addressed in your e-book that I would like your thoughts on, maybe other readers would be interested as well.

In the context of the standard TTI buy signal, if memory serves me correctly, when a buy signal is triggered you enter with a portion of your portfolio, say 1/3. Then if your fund(s) gain by 5 or 7% or whatever you begin the incremental buying of another 1/3 or so of portfolio value.

If I’ve got that right so far then what should a hedge position do if the hedge value shows a 5 or 7% gain and, let’s say that the TTI has not entered buy signal mode. Should the entire hedge position be incremented (SH and two funds), should another hedge position be created entirely distinct from the original, should an investor simply ride it out until if and when the buy signal is reached, or is rebalancing supposed to absorb this scenario?

I’m guessing it’s mostly incumbent upon the individual but if you have any experiential wisdom to share that would be most appreciated.

G.H.

Hello,

Much thanks to Foster and Ulli’s

great forum and resource. Would

be very interested to know, from

Foster, what % of of your total

Financial Portfolio did you choose

to allocate to this hedge (or was

it initially a small test position)? Thanks R

GH,

Yes, you are right; that is strictly up the individual investor. Personally, I have added another hedge to one of my accounts, after I saw that it went my way. Subsequently, when rebalancing, I have increased the exposure to 90% of portfolio value. There is no hard and fast rule.

I can only recommend that readers experiment a little to get a better feeling how a hedge moves in up and down markets. Once you realize the reduced risk as opposed to outright long or short positions, you will want to use it all of the time especially during volatile market periods.

Ulli…

R,

Foster had mentioned that he used 10% of portfolio value.

Ulli…