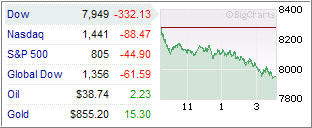

The markets gave incoming President Obama a grand 5-minute inauguration honeymoon period before the selling continued and the major indexes headed sharply lower with the November 2008 lows (752 on the S&P; 500) now clearly in sight.

The markets gave incoming President Obama a grand 5-minute inauguration honeymoon period before the selling continued and the major indexes headed sharply lower with the November 2008 lows (752 on the S&P; 500) now clearly in sight.

The problem remains the same in that banks and other financial institutions have not come forward and disclosed all losing investments they carry on the books. The result is that this information is being only spoon-fed to the public on a need-to basis causing continued surprises.

The latest disaster came from money management firm State Street, which disclosed large unrealized losses and saw their stock price being severely punished by losing 59% yesterday. There was simply no good news anywhere for financials as B of A fell 29%, Wells Fargo was downgraded and, on Monday, Royal Bank of Scotland lost 67%.

I thought for sure that the December rally would carry the markets higher through at least inauguration. The fact that it didn’t simply confirms how little government sponsored bailout programs have done and how fast the economy is deteriorating. The fact that you can now read online that some consider the entire banking system to be insolvent should come as no surprise to readers of this blog.

Besides the promises and grand intentions of the new administration to create jobs and stimulate the now comatose consumer into getting back up and continue consuming, what else could be done to solve the crisis? For some realistic ideas, which of course are not politically acceptable, Dr. Housing Bubble offers these thoughts:

(a) Pick a handful of banks and that is it. They’ll be the banks of the country. All others implode or fight for their own survival.

(b) Those that are picked are now owned by us. Screw it. If we are pumping money into them we dictate how they are run. As the people’s bank, we choose where the money goes.

(c) Bad assets get forced down either by cram-downs or mark to market. Bring all of it into the open. Those that make it, survive another day. Those that don’t, implode on their bad loans and should be gone.

(d) Ramp up FBI/DOJ prosecutions. Those that bet on this market and caused this bubble deserve to have their money yanked from them. Create a trust fund where all their wealth is taken into custody for the greater good. That should yield a few billion.

(e) Triage foreclosures. Someone making $30,000 will not make it in a $300,000 home. Foreclose. Someone making $70,000 will not be able to manage their $500,000 mortgage in California. Foreclose. Do this quickly and get it over with. All these other programs are only prolonging the pain. We have another viable option. It is called renting. Over 50 percent of the 10,000,000 people in L.A. County do this. We need to get away from this “American Dream” according to the real estate industry meaning everyone deserves a F-150 and a 3,000 square foot McMansion with a plasma in every room.

(f) Those banks that are standing cannot use funds to buy out other companies! Look at BofA buying out Merrill Lynch. Now they need more money. Banks that fail will be broken up in bankruptcy and sold off to the highest bidder, period. Otherwise you are going to get banks like Citi and Bank of America hoarding tax payer money to buy out failing banks. Totally inconsistent process which smells of cronyism. Banks being bailed out should run like utility companies.

There you have it. Good ideas that will never be implemented because they make sense.